Report issued by competition commission of Pakistan (CCP) urges unbundling of SOEs, stronger regulation, and private sector entry.

The Competition Commission of Pakistan (CCP), in its detailed review of the country’s Liquefied Natural Gas (LNG) sector, has recommended a sweeping set of reforms to dismantle structural monopolies, promote private investment, and strengthen regulatory oversight. The report draws on the International Monetary Fund’s Public Investment Management Assessment (PIMA) Report 2023 and the State-Owned Enterprises (SOEs) Triage: Reforms and Way Forward Report 2021, both of which emphasize the need to liberalize markets where state-owned enterprises (SOEs) dominate.

To address these challenges, the report proposes the following regulatory reforms. CCP calls for ‘One-Stop-Shop’ for LNG Import (Short Term) and establish a Central Coordination Committee (CCC) to streamline coordination among stakeholders and address licensing issues. Amend the LNG Policy 2011 to empower the CCC.

It also stresses on enhancing Transporters’ Role in Access Arrangements (Short Term): The Pakistan Gas Network Code is amended from time to time as required. However, it is needed that all the relevant stakeholders including the private sector are consulted while making amendments.

Read More: How to Check SNGPL Bill Online

Also, it is imperative to ensure timely and equitable access to pipelines for new entrants, adhering to Third Party Access (TPA) Rules 2018 Fast Track Notification and Implementation of Third-Party Access Rules for Terminals (Short Term): Finalize the processing, notification, and implementation of third-party access rules for LNG terminals to encourage private investment while ensuring competition. Fast track relevant amendments in the OGRA Ordinance 2002 to implement these changes.

Forecasting and Decision-Making (Medium Term)

The CCP urges to improve demand planning and forecasting capabilities, and enhance the OGRA’s capabilities for better demand forecasting protocols. · Unbundling SOEs – The Sui Companies (Long Term): Amend the OGRA Ordinance 2002 to support the unbundling of SOEs, separating their transmission and distribution functions. Draw lessons from Japan’s Gas Business Act (2015) to guide this process.

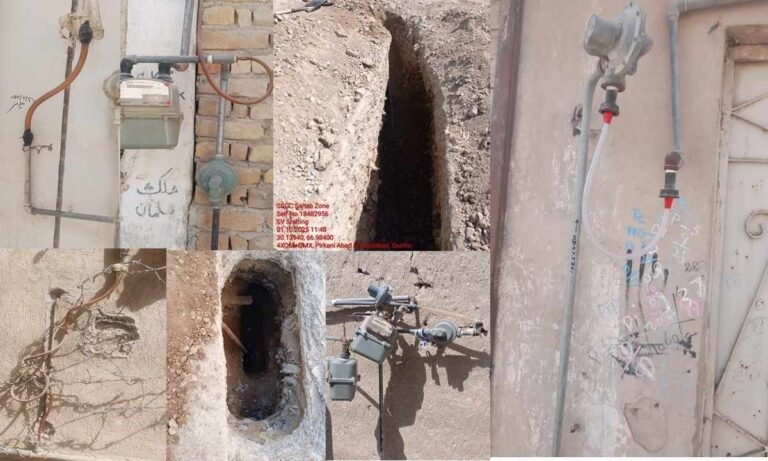

Managing Unaccounted-For-Gas (UFG) Losses by Sui Companies (Medium Term)

Devise and implement a three-year plan to reduce UFG losses, with annual reduction targets and specific plans for law-and-order-affected areas. Align these plans with the Economic Coordination Committee’s (ECC) policies.

The LNG sector in Pakistan is at a crucial juncture, where strategic interventions and regulatory reforms are necessary to transition towards a more liberalized and competitive market. Addressing the identified barriers through specified regulatory changes and policy amendments will enhance the sector’s efficiency, contribute to long-term energy security, and align with international best practices.

These steps are essential for fostering a competitive environment that drives innovation, reduces costs, and benefits consumers and the overall economy. By aligning these efforts with the PIMA framework, Pakistan can ensure a transparent, diversified, and resilient LNG industry, which is capable to adopt innovative solutions like virtual pipelines to expand market

The International Monetary Fund’s (IMF) ‘Public Investment Management Assessment (PIMA) Report’, 2023 inter alia, recommends implementing the ‘State Owned Enterprises (SOEs) Triage: Reforms and Way Forward” Report, 2021, which was prepared under an extensive collaboration and consultative work among the Ministry of Finance, IMF, the World Bank and the Asian Development Bank (ADB).

The SOEs Triage Report refers to a comprehensive review of existing SOEs’ portfolio for the purpose of their categorization for retention, privatization and liquidation initiated in November 2019, as a part of the IMF Extended Fund Facility 2019- 22 structural benchmark.

IMF’s PIMA Report recommends preparing reports on the state of competition in the key markets with significant SOEs’ presence in Pakistan. These key markets include the Liquefied Natural Gas (LNG), as a sub-sector of the oil and gas sector.

This report examines the state of competition in Pakistan’s LNG sector, characterized by a significant presence of SOEs. The analysis covers the regulatory framework, market structure, and barriers to competition, offering strategic recommendations to foster a more competitive environment.

Pakistan’s energy portfolio significantly benefits from natural gas, accounting for 29% of the total energy supply (TES) in 2021, making it the second-largest energy source in the country. Despite this substantial share, the domestic production has struggled to keep pace with the growing demand due to security issues, economic disincentives, and natural decline in production.

Consequently, Pakistan has resorted to LNG imports since 2015, which now constitute about 23% of the country’s domestic natural gas consumption. Market Structure and Key Players: The LNG market in Pakistan features a mix of SOEs and private entities, with SOEs playing a dominant role in the import and distribution of LNG.

The SOEs, namely Pakistan State Oil (PSO), Pakistan LNG Limited (PLL), Pakistan LNG Terminals Limited (PLTL)), Sui Southern Gas Company Limited (SSGCL), and Sui Northern Gas Pipelines Limited (SNGPL) significantly impact market dynamics and competition.

These entities are deeply integrated into the core operations of the sector, from LNG import to transmission and distribution across the country. Consequently, the SOEs exhibit a certain level of monopolistic market structure within the domain of their business. At the same time, there seems to be reluctance on the part of the private sector to materialize projects beyond proposals.

Several factors are responsible for this state of affairs and lack of competition, which are further explored in the report. Long-term contracts are a thumb rule in the global LNG trade. This has pros and cons for both the suppliers and customers.1 For instance, the supplier gets ensured demand for huge capital intensive infrastructure. Customers, on the other hand get an ensured availability of LNG at stable price. Likewise, the Pakistani market is heavily reliant on long-term contracts, particularly with suppliers like Qatar. For a country like Pakistan, it seems crucial to keep a balance between long term contracts and spot purchases.

This would allow for greater market fluidity and responsiveness to price signals. The present model limits price flexibility and competitive market behavior. Regulatory Framework: The regulatory framework, governed primarily by the Ministry of Energy and the Oil and Gas Regulatory Authority (OGRA), who devise policies and procedures for the LNG sector. However, there are issues such as stringent licensing requirements, fast track approval and implementation of TPA rules for LNG terminals, tariff settings, and government influence that often skew the market in favor of SOEs, posing significant barriers to new entrants and fair competition.

Barriers to Competition: This Report identifies several barriers to competition, which are described in report.

Regulatory Barriers

The OGRA Ordinance 2002 imposes stringent licensing requirements, deterring new market players. OGRA’s tariff settings often favor SOEs. Moreover, low fixed profit margins for the LNG importing SOEs regulated by the OGRA leads to non-competitive import pricing, making it an unattractive market for the private firms to enter.

Moreover, government guidelines frequently prioritize SOEs through regulatory support, making it difficult for potential entrants of private sector to enter the market and compete. Alongside, stringent tariff settings have led to financial losses to SOEs.

The report explores any such inconsistencies in the regulatory framework, which hinder growth of the industry. · Structural Barriers: SOEs like Sui Southern Gas Company Limited (SSGCL) and Sui Northern Gas Pipelines Limited (SNGPL) control major infrastructure, restricting access for private entities. High capital costs favor SOEs with government backing, deterring new entrants.

Market concentration among entities like Pakistan LNG Limited (PLL) and Pakistan State Oil (PSO) limits competition. Additionally, circular debt in the gas sector, which rose to PKR 2,866 billion by January 2024, exacerbates these barriers. This debt accumulation is due to delayed tariff adjustments (no tariff increase in last three years), sector inefficiencies (unaccounted-for-gas losses), and the diversion of costly RLNG to domestic consumers in winter.

Behavioral Barriers: Long-term contracts secured by SOEs may limit market liquidity and competition. Likewise, preferential treatment through subsidies and access to government-backed financing may create an uneven playing field for potential new market entrants.