Refinery Output Rises 12.6% in September on HSD Gains

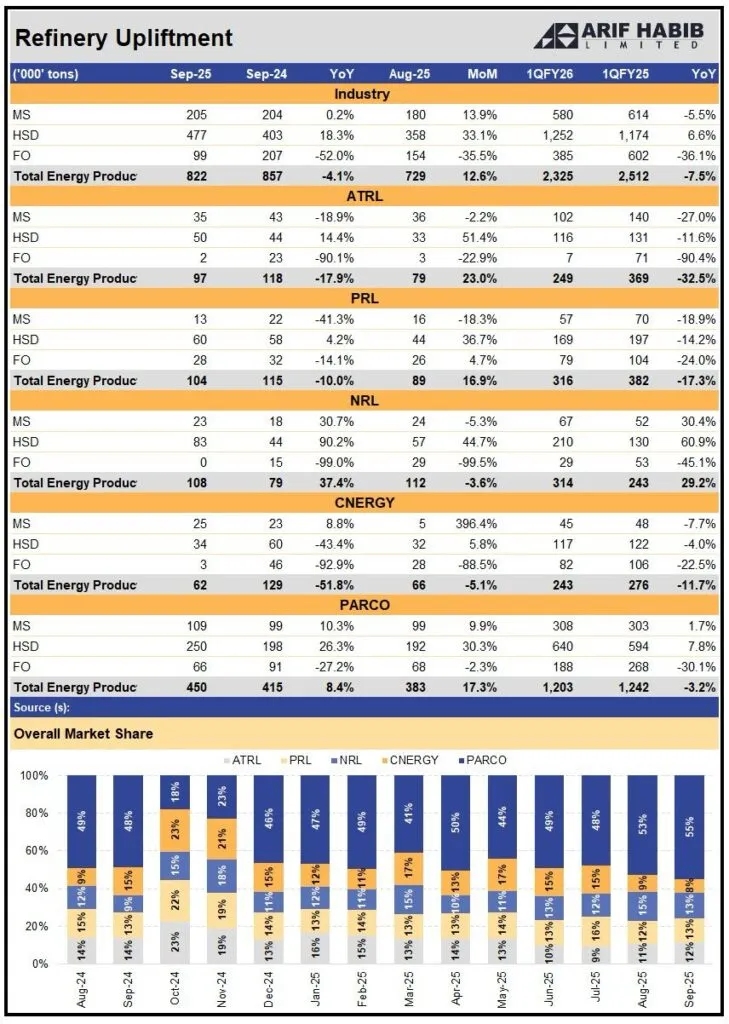

Pakistan’s refinery production increased 12.6% month-on-month in September 2025 to 822,000 tons. This is driven by higher diesel output, though year-on-year production declined 4.1%, according to data compiled by Arif Habib Limited.

The latest “Refinery Upliftment” report showed that High-Speed Diesel (HSD) was the key growth driver. It surged 33.1% from August to 477,000 tons.Refineries claim Rs 47 billion losses

On a yearly basis, HSD output jumped 18.3% against September 2024 which reflected improved transport and industrial demand.

Seasonal fuel consumption picked up ahead of the winter months. In contrast, Furnace Oil (FO) production dropped sharply by 52% year-on-year to 99,000 tons.

Refineries continued to cut back on low-margin residual fuel due to weak domestic demand and the shift towards more efficient energy sources.

Motor Spirit (MS) represents petrol and its production remained almost flat at 205,000 tons, a marginal 0.2% rise compared to a year earlier. However, it was up 13.9% month-on-month.

Cumulatively, during the first quarter of FY26 (July–September 2025), the total industry production surged 8.0% year-on-year to 2.51 million tons against 2.33 million tons in 1QFY25.

HSD volumes were up 6.6% and FO still lagged behind with a 36% contraction.

Among individual refineries, Pak-Arab Refinery Company (PARCO) retained the largest market share. It contributed 55% of the total industry uplift in September, up from 49% a month earlier.

PARCO’s total output reached 450,000 tons which was up 8.4% year-on-year and 17.3% month-on-month. It is backed by robust production of HSD and MS. Diesel output at PARCO climbed 26.3% year-on-year to 250,000 tons. MS production surged 10.3% to 109,000 tons.

National Refinery Limited (NRL) also reported strong year-on-year growth of 37% to 108,000 tons in total production. It is driven mainly by a 90% surge in HSD volumes. NRL’s performance was particularly notable compared to other players. It showed consistent improvement over the last quarter. Its total output rose around 30% in 1QFY26 versus 1QFY25.

However, Pakistan Refinery Limited (PRL) posted a 10% year-on-year decline in September output to 104,000 tons. However, it rebounded a 16.9% month-on-month.

HSD volumes surged modestly by 4.2%. But MS and FO fell 41% and 14%, respectively. During the quarter, PRL’s production was down 17.3% from last year. It is largely due to lower throughput and weaker MS yields.

Attock Refinery Limited (ATRL) witnessed a steeper contraction. Its total output dropped 17.9% year-on-year to 97,000 tons. However, production jumped 23% on monthly basis.

Its diesel production surged 51% from August. But it was still down 14% on a yearly basis. Petrol production fell 19% year-on-year whereas furnace oil production dropped by 90%. Over the first quarter, ATRL’s cumulative production fell 33% against 1QFY25. It reflects lower operational efficiency and reduced domestic offtake.

Cnergyico PK Limited (CNERGY) has remained the weakest performer in September. It reported a steep 51.8% year-on-year decline in total production to just 62,000 tons.

Despite a 5% month-on-month decrease, its MS production rose 8.8% year-on-year. It indicates partial stabilization. However, FO and HSD volumes continued to lag and dropped 93% and 43%, respectively. On a quarterly basis, Cnergyico’s total production slipped 12% year-on-year to 243,000 tons.