Refineries Policy: No import duties, sales tax on crude import

Ibn-e-Ameer

The government has exempted oil refineries from import duties and Sales Tax on import of Petroleum Crude oil with effect from July 1, 2022.

Refineries will use petroleum crude oil as the main raw material for finished products in the new policy 2021.

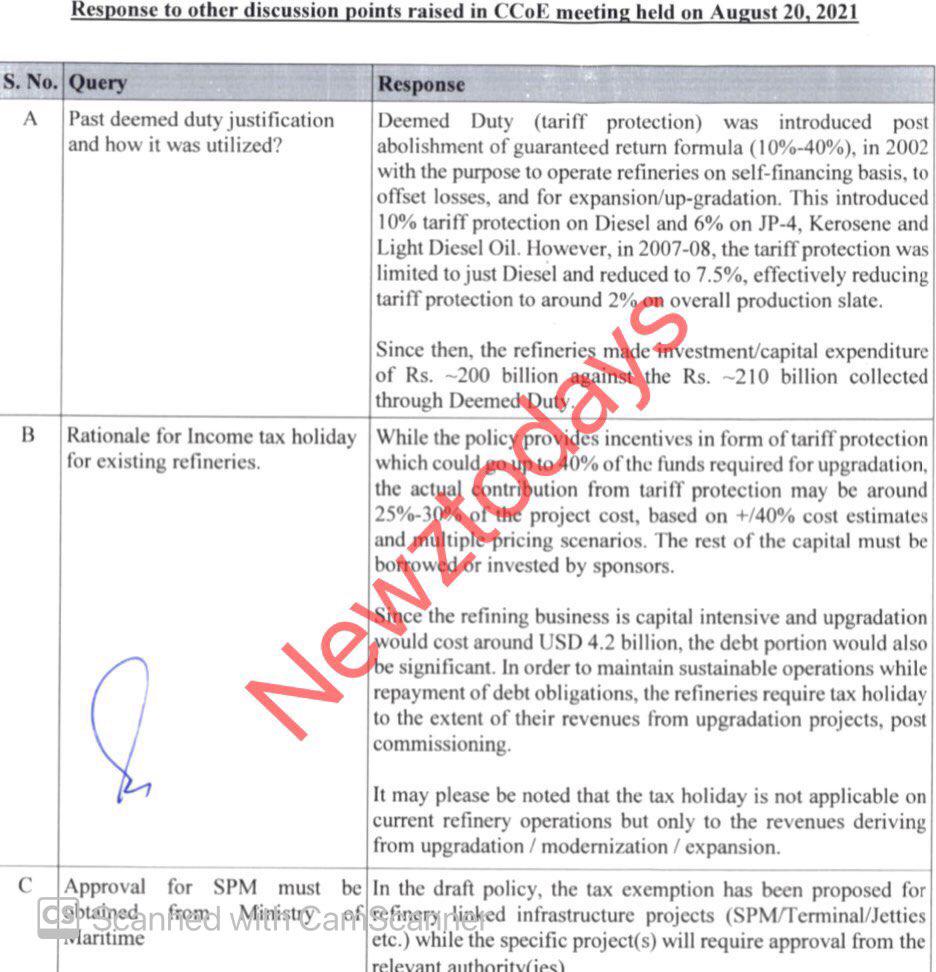

The petroleum division has informed the cabinet committee on energy (CCoE) in the revised draft of the Oil refinery Policy 2021.

The petroleum division has proposed to base the Product Pricing Formula of refineries on “True Import Parity Price” in the new policy.

The government will also add all other elements like Premium, Freight, Port Charges, Incidentals, Import Duties, exchange rate, provincial taxes.

In addition, it will also apply other price adjustments in line with PSO actual imports, in the FOB price to arrive at True Import Parity Price.

Read More: Govt to finance 26% in refineries up-gradation projects

However, the government will add prevalent Inland Freight of imported crude oil to refineries and provincial duties at the import of crude oil shall for refineries.

The government will charge import duties and sales tax on the finished products. However, there will be no guarantee of the rate of return available for existing refineries.

The government will also allow a certain portion of export proceeds in foreign currency to meet operational requirements.

10% Protection to Existing refineries

At present, the government is providing protection for high-speed diesel. In the proposed refinery policy, the government will provide tariff protection of 10% import duty on Motor Gasoline and Diesel of all grades.

It will also be applicable on imports of any other white product used for fuel for any kind of motor or engine, effective from January 1, 2022, to December 31, 2027.

Fiscal Regime

The government will announce a 10-year income tax holiday of all taxes under the Income Tax Ordinance 2001.

It will be applicable from the date of commissioning of the up-gradation/modernization/Expansion and petrochemicals project.

The government will also be exempt from customs duties, surcharges, withholding taxes, or any other levies on the import of any equipment.

It will be available for refineries for material or equipment to install or use in the refinery without any precondition for certification by Engineering Development Board.