Auto sales of local assemblers may jump 3% despite SBP’s restrictions

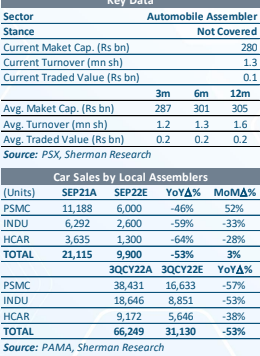

Auto sales of local assemblers are likely to improve by a meager 3%MoM to 9,900 units in September 2022.

These estimates of auto sales of local assemblers include provisional sales of major local players listed on PSX.

Analysts believed that lower demand remains the key factor behind the slump in car sales over the last few months after a record increase in car prices amid the Pak rupee devaluation, costly leasing, and higher taxes.

Despite the anticipated Month on Month (MoM) decline in production, inventory levels remain adequate to fulfill car orders during September.

We believe that car production in September to remain lower by 60% compared to average monthly production during 1H2022, Sherman Research said in a report.

This remained much lower than the SBP’s restrictive CKD import policy which directed local car assemblers to operate at around 60% production capacity.

Company-wise data shows that sales of Pak Suzuki (PSMC) post a sharp recovery of 52%MoM mainly led by Swift and WagonR.

On the flip side, sales of Indus Motors (INDU) and Honda Cars (HCAR) are likely to further plunge by 33% and 28% to 2600 and 1300 units, respectively, Sherman Research said in a report.

The decline in sales of INDU is mainly led by the company’s flagship Corolla while Yaris which is another famous brand is also anticipated to decline on a MoM basis.

Moreover, subdued demand for Civic and BR-V led to a decline in sales of HCAR.

Thus, cumulatively during 3QCY22, car sales are likely to remain lower by 53% versus last year.