Fertilizer | Price Discount Led to Growth in Urea Sales During CY25

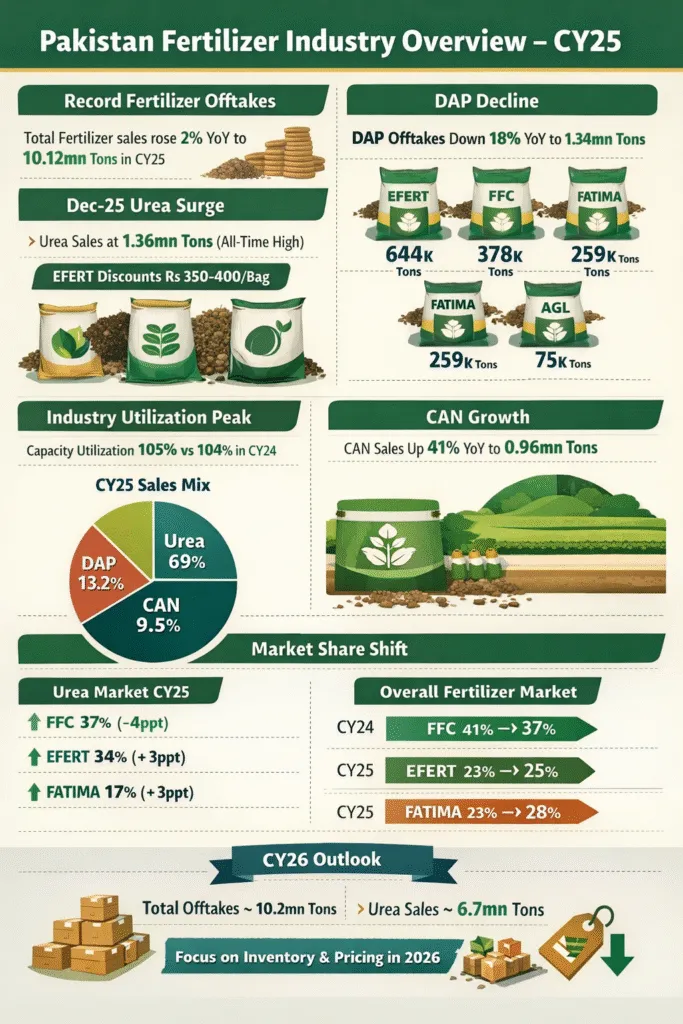

Pakistan’s total fertilizer offtakes reached 10.12mn tons in CY25, registering a growth of 2% YoY. The increase was primarily driven by exceptionally strong urea sales of 1.36mn tons in Dec-25, marking an all-time high monthly offtake and surpassing the previous peak recorded in Dec-19.

As a result, cumulative CY25 urea offtakes stood at 6.73mn tons, representing an all-time high on a calendar-year basis. The surge in December sales was supported by strong dealer demand due to hefty price discounts of Rs350–400 per bag offered by EFERT to offload higher inventories. Company-wise, EFERT led December offtakes with 644K tons, followed by FFC 378K tons and FATIMA 259K tons, while AGL contributed 75K tons.

In contrast to urea, DAP offtake declined sharply by 18% YoY to 1.339mn tons during CY25, primarily due to higher prices, which prompted a shift in farmer preference toward more cost-effective nutrient alternatives amid continued pressure on farm economics.

Industry Utilization Peaks in CY25

The fertilizer industry recorded a new high in CY25, with aggregate capacity utilization reaching an all-time peak of 105%, compared to 104% in CY24. During CY25, urea contributed 69% of sales, whereas sales of DAP and CAN constituted around 13.2% and 9.5%, respectively.

Interestingly, CAN registered the highest growth of 41% in sales, rising from 0.67mn tons in CY24 to 0.956mn tons in CY25. Despite the lowest price gap between the two fertilizers, which was usually higher in the last few years, farmers preferred buying CAN as the product is comparatively cheaper than urea.

Read More: New Fertilizer Policy: Govt to review Gas pricing for fertilizer plants

Considering adequate CAN inventory, we may see sales of CAN improving further in CY26. Thus, we expect total fertilizer offtake to slightly improve to 10.2mn tons, whereas urea sales are expected to remain around 6.7mn tons in CY26. Going forward, all eyes will be on fertilizer prices, as fertilizer units may prefer to offload inventory buildups, as seen in December 2025, by offering phased discounts to avoid excessive stock accumulation,” Sherman Research said in a report.

EFERT Gaining Market Share in CY25

FFC continued to dominate the urea market in CY25; however, its market share declined by 4ppt YoY due to aggressive price competition by EFERT. EFERT’s market share increased to 34%, reflecting a 3ppt YoY expansion, while FATIMA’s share rose from 14% to 17%, supported by its own pricing-led volume push.

Elevated DAP Prices Weigh on CY25 Offtake Amid Strained Farm Economics

Total DAP offtake declined to 1.34mn tons in CY25, down 18% YoY, largely reflecting elevated DAP prices (up 9% YoY) that constrained farmer affordability and demand.

The slowdown was broad-based across manufacturers. FFC reported DAP sales of 835K tons, down 16% YoY, outperforming the industry decline and resulting in a market-share gain to 62% from 61%. In contrast, EFERT’s DAP offtake fell sharply to 166K tons, down 46% YoY, while Fatima Fertilizer also posted weaker volumes of 32K tons, down 36% YoY, highlighting the broad-based impact of higher pricing on DAP demand across the sector.

Both Fatima and EFERT Gained Overall Market Share, Fatima Sales Up 16% YoY

Fertilizer market dynamics shifted notably in CY25, underpinned by an all-time high urea offtake in December, which supported total fertilizer offtakes of 10.12mn tons for the year. This was broadly in line with last year’s level of 10.23mn tons, translating into a modest 2% YoY growth.

Despite stable industry volumes, FFC’s market share declined by 4ppt YoY to 37% from 41%, primarily driven by a 6% and 16% contraction in urea and DAP offtakes, respectively. EFERT, on the other hand, gained share, with its market share increasing by 2ppt YoY to 25%, largely supported by a 14% YoY growth in urea offtakes, attributable to factors discussed earlier. FATIMA also strengthened its market position, with market share rising to 28% from 23%, mainly due to a 16% increase in total offtakes, led by higher sales of urea (up 21% YoY) and CAN (41%).