Loan Apps that Work With Cash App| Updated Oct 2023

By Newztodays Team

Looking for cash advance apps that work with Cash App? The answer may surprise you – in most cases, Cash App and these loan apps aren’t directly compatible.

However, there’s a solution: you can connect them through bridge accounts to facilitate fund transfers.

Cash App itself offers borrowing options to its users, but there are alternative apps with unique terms and conditions for loans.

Did you know that a significant 56% of Americans lack sufficient savings to cover a $1,000 emergency expense?

If you find yourself in a similar situation, searching for a way to quickly secure cash for your needs, you’re not alone.

We’ve done research on same-day loans that accept cash without the hassle, and some even offer free money as part of their packages.

If you’re in need of easy and instant advance loans and prefer to avoid traditional banks, look no further. Thanks to technology, you can now access advanced loans with just a few clicks.

Here, we’ll introduce you to a few loan apps that can work in conjunction with Cash App to provide hassle-free loans.”

Key Takeaways

- The Cash app is a popular payment app that allows users to send and receive money easily.

- These loan apps offer flexible repayment plans and low-interest rates, making them attractive options for those who don’t have access to traditional forms of credit.

- There are several loan apps that work with the Cash app, including Earnin, Dave, MoneyLion, and Branch.

- These loan apps offer short-term loans to help users cover unexpected expenses.

- To use a loan app with the Cash app, you need to create an account with the loan app, link your bank account, and then connect your Cash app account to the loan app.

- It’s important to compare loan options from multiple providers and read the terms and conditions carefully before applying for a loan.

What are Advance Cash Apps?

They are getting more and more popular because they make it easy and safe to borrow money without going to the bank or using other old methods.

There are a few types of loans you must know if you are looking.

The two most popular loan Apps that work with Cash App are the Albert app and Chime App.

Moreover, Cash App also has a borrowing feature that offers you instant loans.

We have done rigorous research to find you the best methods and apps that work with Cash App and offer you instant advance loans.

Let’s not waste more time and dive into reading more about loan apps that may be helpful and offer convenient lending for you. You can also get free money by using these loan apps.

A Quick Loan Apps Comparison

| Loan App | Compatibility with Cash App | Advance Amounts | Fees/Interest | Repayment Terms | Special Features |

|---|---|---|---|---|---|

| Earnin | Indirect (via bridge account) | Up to $100/day, $750/pay period | Fast-funding fee: $1.99 to $4.99, Optional tip up to $13/advance | Withdrawn on next payday | Access to wages before payday, connects with bank account |

| Dave | Indirect (via bank account) | Up to $500 | Subscription: $1/month, Fast-funding: $1.99 to $13.99, Optional tip up to 25% of borrowed amount | Withdrawn on next determined payday | Budgeting tools, no overdraft fees, same-day loans with fees |

| MoneyLion | Indirect (via bank account) | $500 to $1,000 | Monthly: $19.99, APR: 5.99% to 29.99% APR, Credit monitoring: $0, RoarMoney admin: $0 for CB+ members | Principal + APR payment | Financial services, loans, spending and saving tools |

| Branch | Indirect (via Venmo) | Not specified | $2.99 to $4.99 for instant advance | Not specified | Personal finance services, virtual bank, bill pay |

| Albert | Direct | Up to $250 | No interest; $5 borrowing fee | Not specified | Instant loans, signup bonus, budgeting assistance |

| Chime | Direct | Up to $200 | No interest | Not specified | Debit card, bank account services, automatic savings, round-up transactions |

| CashUSA | N/A | $500 to $10,000 | Varies by monthly income and employment status | Not specified | Emergency loan services |

| PersonalLoans | N/A | $100 instant loan | Not specified | Not specified | Personal loan services |

| 24/7DollarLoan | N/A | $100 instant loan | Not specified | Not specified | Quick loan processing |

| Funds Joy | N/A | $100 instant loan | Not specified | Not specified | Instant advance loan services |

| ZippyLoan | N/A | $100 instant loan | Not specified | Not specified | Fast loan services |

Compatibility of Cash App with Loan Apps

Cash App is itself a digital payment service and offers loans to its users. Therefore, if you are a Cash App user, you might be looking to use it with other loan apps.

However, Cash App does not have direct compatibility with some loan apps like Earnin.

But you can still use this app to get a loan from other loan apps.

| Loan App | Compatibility with Cash App | Method of Connection | Notable Conditions |

|---|---|---|---|

| Earnin | Indirect (via bridge account) | Connect through a shared bank account | Requires linking with bank account for cash advances |

| Dave | Indirect (via bank account) | Link both to the same bank account | Requires a bank account with direct deposit arrangement |

| MoneyLion | Indirect (via bank account) | Link through a bank account | Funds transferred to bank account, then to Cash App |

| Branch | Indirect (via Venmo) | Use Venmo as a bridge between apps | Requires linking both apps to Venmo |

| Albert | Direct | Direct transfer to Cash App | Allows instant loans transferable to Cash App |

| Chime | Direct | Direct connection possible | Offers advance cash compatible with Cash App |

How to Connect Cash App with loan apps?

If you are a Cash App user, it must be a matter of concern for you how to connect it with other loan apps to borrow money.

Some apps like Albert Work Cash App and you can link these two directly.

However, you can link the cash app with those loan apps that are not compatible with third parties or using similar bank accounts.

A list of cash advance apps that work with cash app

These apps are also called by the customers same-day loans that accept Cash App. However, we have found a list of these best loan apps that work with cash apps either directly or through a bridge account.

Earnin’

The first and best loan app that you can use with the Cash app is Earnin. It is a financial app that allows you to access your earned wages before your paycheck arrives.

It helps people to meet emergency expenses when they are in dire need of money.

It allows you to get a loan against your wages,

You can think of it as a way to get a cash advance on your paycheck without having to pay the high fees that come with traditional payday loans.

How to Connect Earnin with Cash App

Earnin and Cash app are two digital apps that work differently. They do not work together but they can be connected with a bridge account.

Connecting Earnin with Cash App

- Initial Setup

- Earnin App: Install and set up Earnin for advance wage access.

- Cash App: Install and set up Cash App for monetary transactions and stock purchases.

- Earnin Account Setup

- Provide Employment Info: Register your employment details on Earnin.

- Link to Bank Account: Connect Earnin to your primary bank account.

- Approval Process: Wait for Earnin to approve the connection to your bank account.

- Using Earnin for Advances

- Advance Request: Once approved, request a cash advance in Earnin (up to $500).

- Fee Deduction: Acknowledge that Earnin will deduct its fee on your next payday.

- Cash App Account Setup

- Bank Account Linking: Link your Cash App to the same bank account connected to Earnin.

- Transferring Funds

- From Earnin to Bank: After receiving your advance in Earnin, the funds go to your linked bank account.

- From Bank to Cash App: Transfer the funds from your bank account to Cash App as needed.

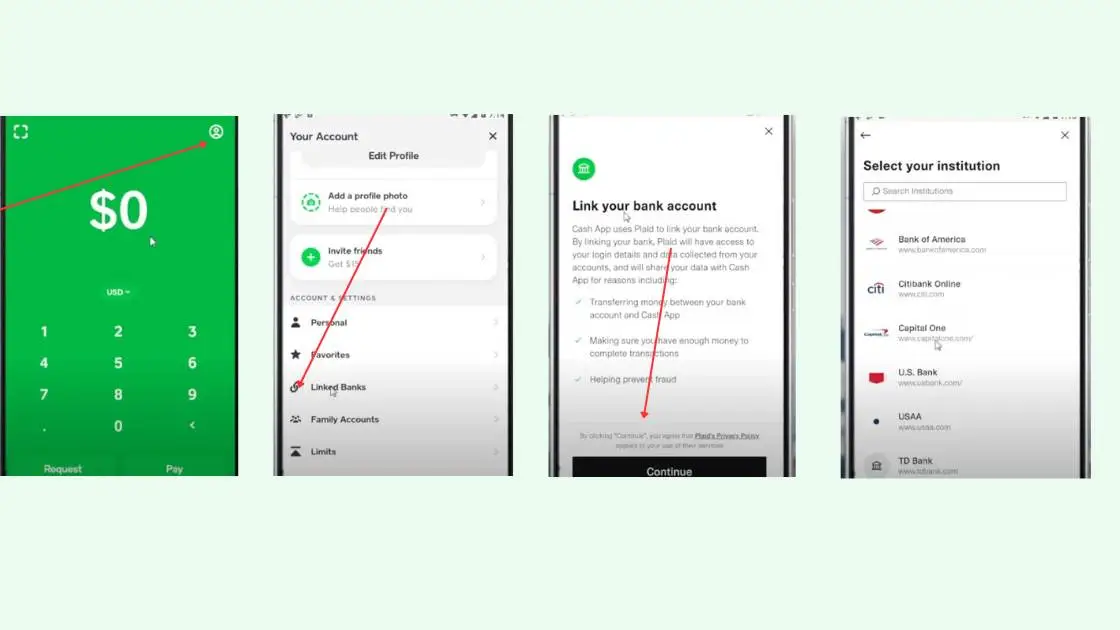

How to Connect Cash App to Bank Account

Here are a few steps you can follow to connect it with a bank account.

- Launch the Cash App and click on the profile icon in the top left corner.

- Click on the “Linked Banks” option

- Click on “Link Bank”

- Tap on your bank name from the list

- Enter your bank information

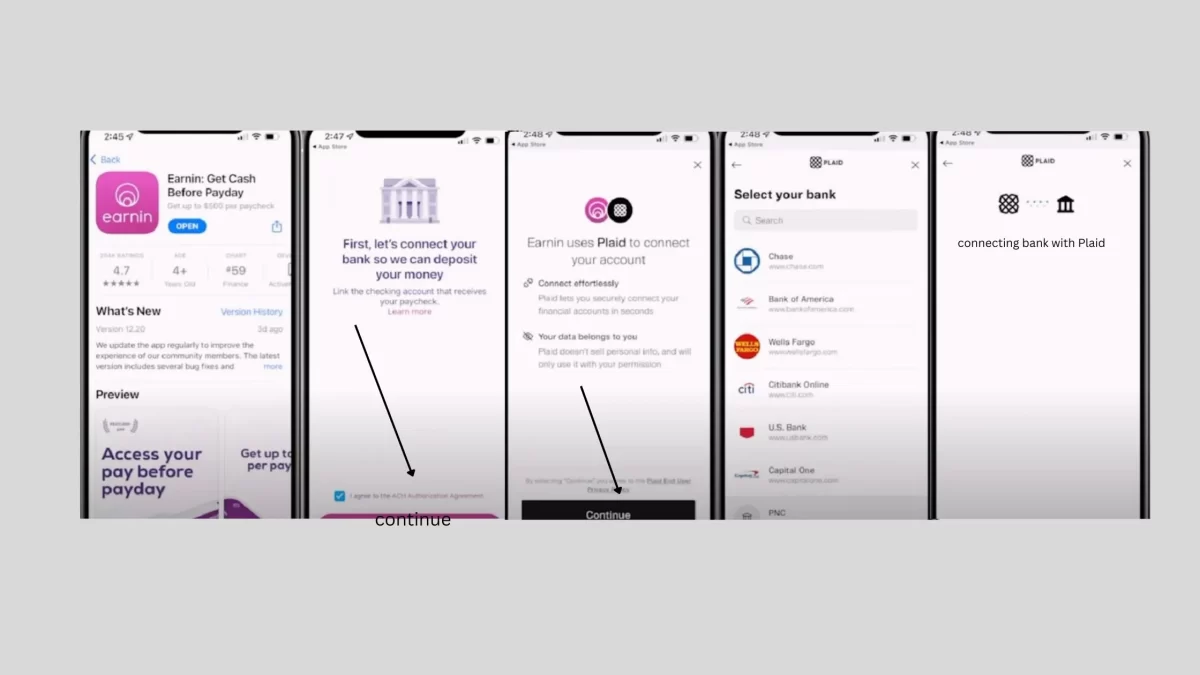

How to Connect Earnin with a Bank Account?

Here are a few steps you can follow to connect Earnin with a Bank account

- Open the Earnin App on your smartphone and click on the profile icon

- Click on the “Bank Account” option

- Earnin uses Plaid to connect your account. Click on “Continue”.

- Select Your Bank and click on Continue. You will see a connecting bank with Plaid.

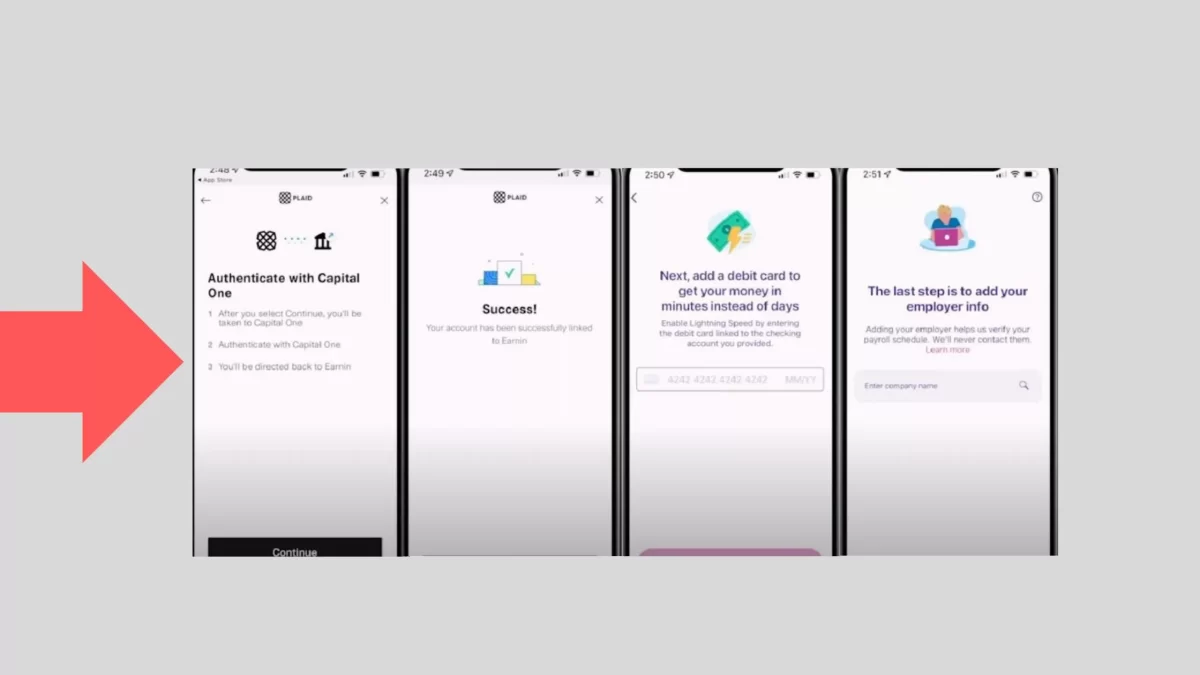

- You will find an option “authenticate with Capital One”. Click on continue.

- There will be a mark of “success”.

- The next option will be adding a debit card to get your money.

- Earnin App will ask for the last option of adding your employer information.

By following these steps, if you connect these two apps with a similar bank account, you will be able to get access to your money.

Branch

Branch, similar to Cash App, Dave, and Moneylion, offers financial services and loans through its mobile app.

While it functions as a virtual bank and provides various financial features, it doesn’t have direct compatibility with Cash App.

To make Branch work with Cash App, you can link both apps by connecting them to your bank account.

Once you’ve obtained a loan through the Branch to your bank account, you can then transfer the funds to your Cash App account.

However, these apps may have varying loan amounts, interest rates, and fees. Always carefully review their terms and conditions before applying for a loan.

Additionally, comparing loan options from multiple providers is a wise practice to ensure you’re getting the best possible deal.

As for direct integration, Branch, like Earnin, doesn’t have native compatibility with Cash App.

However, if you want to link them, you can use third-party services like Venmo or PayPal as intermediaries.”

How to Connect Branch with Cash App

If you want to connect Cash App with Branch, you will have to connect the Branch account to Venmo,

The Venmo app will work like a bridge account between the Branch and the Cash App.

Here are steps to connect the Branch to the Venmo app.

- Launch Venmo on your smartphone and click on the “Setting” option

- Click on “Payment Methods” and press “Add bank account”

- Click on “ Branch” in the payment option

- Put information about your bank account number and routing number

- Press “Link account”

After linking these two accounts, you can use Venmo to move money.

Cash App and Venmo also do not work directly. But you can connect these two apps by linking them both with a similar bank account.

How to Link Cash App and Venmo accounts with the same bank

The process is very easy.

Linking Venmo with a Bank Account

- Launch the Venmo App on your smartphone

- Open the “Settings” option and click on “Payment Method:

- Press “Add Bank Account” and Provide your bank account information

- Press “Link Account”

Linking Cash App with Bank Account

- Luanch Cash App on your andriod

- Press on “Banking” Option

- Click on “Link a Bank Account”

- Provide details about your bank account

- Press “Link account”

So, these are simple methods to connect Venmo and Cash app accounts with similar banks.

After you are done, Venmo will work as a bridge account between the Branch and the Cash App to send and receive money.

So, if you get a cash advance on Branch, you can move that money into a Venmo account that would be transferred onward to Cash App,

How to Transfer Money from Venmo to Cash App

There are a few tips to help you to transfer money from Venmo to Cash App.

- Click on Venmo App on your smartphone screen

- Press “Banking” option

- Click on the “Transfer money” tab

- In the linked account, press Cash App

- Enter the desired amount you want to transfer

- Press “Transfer”

How to take a loan from Branch

Follow a few steps below to get a loan from the Branch

- First, open the Google Play Store or App Store on your smartphone

- Download the Branch App

- Sign up for your account

- Click on the “Loans” option and Press “Apply for a loan”

- Provide the loan amount

- Click on the repayment period

- Read out the loan’s terms and conditions and press “Apply.”

The branch will review your application and will deposit a loan amount within 24 hours after the approval.

The Albert App

This is an advanced cash app that works with Cash App and offers you instant loans up to $250 for a free interest rate.

Additionally, you can also get a signup bonus of up to $150 after setting up a direct deposit.

How to Take a Loan from the Albert App?

Follow the steps mentioned below to take a loan from Albert App

- Sign up account on the Albert App after downloading from the Google Play Store or App Store

- Link your Albet App account with your bank account

- Provide your credentials to verify your identity

- Albert App system will review your application

- It can provide a loan of up to $250 after approval

How to Apply for a Loan from Albert?

- Press on the Albert App on your smartphone screen

- Click on the “instant” option

- Click on the “Get Started” option

- Enter the desired loan amount

- Read out the loan’s terms and conditions and click on accept

- Press “Get Instant Cash”

- Loan Terms

- Interest rate zero

- Borrowing fee $5

- Repayment period 30 days

It charges a late fee in case you fail to make a timely repayment.

Does Albert work with Cash App?

Albert works with Cash App. So, if your loan amount is approved by the Albert system, you can transfer it into your cash app account.

- Open the Albert App on your smartphone and click on the “Banking” option

- Click on Transfer Money” option

- Choose “Cash App” in the list of linked accounts in payment methods

- Put the desired amount you plan to transfer

- Press “Transfer”

With a few taps on your mobile phone, you can transfer money from the Albert App to the Cash App. However, it may take a few days to complete the payment process

Chime App

This is another App that works with Cash App that offers you advance cash up to $200.

It requires adding Chime debt or a Chime Bank account as a payment method to use with Cash App.

Dave App

This also works with Cash App by adding Dave’s debit card as a payment method.

Once you add a Dave App debit card to Cash App, you can also transfer money from Cash App to Dave’s account.

You can also withdraw money through the Cash App to make payments.

There are some Apps that may not be directly connected with Cash App.

However, Apps like Dave and Chime may work as a bridge to transfer money between different accounts.

How to Get a Loan on Dave App?

So, you are here to seek guidance regarding a loan from a Dave app. You will have to follow a few simple steps to qualify for a loan. Firstly you will have to create your account on Dave App.

How to Create an Account on Dave App?

- Download and install the Dave App from Google Play Store and App Store on your mobile device

- Press the Dave App icon to open it

- Click on the Sign-Up option. You can also tap on the button “Create account”.

- Enter your email address and phone number to verify your identity

- Verify the code by entering into the app to verify the phone number that you would receive via SMS

- Link it to your bank account

That is all. It is ready now to work.

How to Apply for a Cash Advance?

Check Cash Advance Eligibility Criteria in the Dave App. It reviews your financial data including account history and income to check your eligibility.

- Click on the “Cash Advance” option in the main menu on the home screen.

- Click on the cash advance amount you are looking for. How it relies on your previous financial portfolio.

- Read the Terms and Fees before proceeding

- Following this, confirm the request

- It will transfer the amount into your linked bank account after it is approved by the Dave App

Steps to Consider

- It requires a bank account with a direct deposit arrangement to qualify for a loan.

- Approval depends on your spending history and income

- It charges a $1 per month membership fee

- Same-day loans are also charged some fees

- Fees associated with Dave App’s advance loan

- It receives a $1.99 fee if you avail the same-day loan.

- It also charges a 1% money transfer fee from your Dave account to an associated bank account.

- It will charge a $15 late fee in case you are unable to make timely repayment along with a 15% APR on the outstanding balance.

Note: Cash App and Dave App are not compatible. Therefore, you cannot link the cash app with the Dave App. However, you can transfer funds between these two apps by linking them with the same bank account.

MoneyLion

Like other financial apps, MoneyLion provides financial services and loans.

It also helps you with spending and saving.

As for compatibility with Cash App, MoneyLion doesn’t have a direct integration with Cash App.

How to take a loan from Money Loan using the Cash app?

To take a Money loan using the cash app, you have to follow the below-mentioned steps.

- Sign up for a MoneyLion account and link your bank account.

- Apply for a loan through the MoneyLion app.

- If approved, the loan amount will be deposited into your linked bank account.

- Transfer the funds from your bank account to your Cash App account.

How to unlock borrow on the cash app

Even, if you have a verified account with Cash App and meet eligibility criteria, you can also take an instant advance loan.

You will have to follow a few steps to unlock on Cash App.

- Download the Cash App on your Android

- Register and create your account

- Then, launch the cash app home screen on the mobile

- Select the money icon on the bottom left corner of the home screen

- Navigate the “Banking” header

- Try to find the word ‘borrow’

- If the ‘borrow’ word is visible, it means you can borrow

- Click ‘borrow option’

- Click on ‘Unlock’

- Cash App will inform about the borrowing limit

- Tap your repayment plan

- Then select to proceed

- You will receive funds

Additional Tips You Must Know

Can I overdraft with Cash App?

Though your Cash App is prepaid, therefore, you cannot overdraft your Cash App card.

Being a prepaid card, you are required to have funds in your account if you want to spend and withdraw.

Cash App does not offer optional overdrafts.

So you can use only the available balance in your account. And you can’t withdraw and spend more than what you have available balance.

$100 loan instant app

There are several Apps that offer you a $100 instant loan. We are listing them here so that you can avail of the loan offer.

MoneyMutual

This is considered to be the best App that offers a $100 instant loan to customers.

CashUSA

If you are looking for an emergency loan, then, this is another app that can also provide you $100 instant loan to meet your needs.

bad credit loans

This app also offers a $100 loan in advance. So if you want to have an instant loan, this is also considered to be the best one in this regard.

PersonalLoans

If you are looking for a $100 instant advance loan, you can avail it of by using this app.

24/7DollarLoan

This also offers the best loan of $100, which you can have in case of an emergency.

Funds Joy

Funds Joy also offers a $100 instant advance loan online while sitting at home.

ZippyLoan

This app provides you with a fast loan of $100 you can avail.

Can I get a loan with a Cash App account?

Cash App offers you short-term loans from $20 to $200.You will have to repay it by paying an additional 5 percent flat fee.

What Cash Advance Apps Work with Cash App?

There are few cash advance apps that work with Cash App. They include Albert, Dave, Moneylion, and Earnin. You can have instant advance loans from these apps.

Can I get a payday loan with Cash App?

Cash App offers a loan ranging between $20 to $200 at a flat fee of 5%. If multiplied over a year, it comes to a 60% APR. It looks high but is still lower compared to the average payday loan.

How can I borrow $200 from Cash App?

Open the Cash App home screen and click on the account balance. Then tap the ‘borrow’ option, click on Unblock, and select the repayment option. Then click on the ‘Agree and ‘Accept’ options, and money will be in your account.

Does Albert app loan money?

You can receive up to $250 from Albert if your paychecks are being automatically deposited into your Albert account. You can receive money in your account after you make a request. You can repay a loan with zero interest before you deposit your next paycheck.

What app can I borrow $100 from?

You can borrow a $100 loan by using plate forms like Green Dollar Loans, Big Buck Loans, Viva Payday Loans, Heart Paydays, and Low Credit Finance.

What app can I borrow $50 from?

Many apps like Chime, DailyPay, Bright, and Dave can lend you $50.The majority of apps do not charge interest rates and you are required to pay before depositing your next paycheck.

What app can loan me $250 quickly?

You can try MoneyLion App which is considered to be the best one to give you a $250 loan quickly and fast. However, you will have to pay a fee if you want an instant advance loan.

How can you get $100 fast on Cash App?

You can earn $100 for free in case you have made a direct deposit of your paycheck. However, you will be required a unique routing number and account number to use Cash App along with a valid physical address. In addition, you can also make extra money on account of referrals by sending invitations to family members and friends.

Which app gives instant loans in minutes?

You can use MoneyTap to get an instant personal loan at an interest rate of 1.08% per month.

What app lets you borrow $300?

Vola is another app that allows same-day cash advances amounting to $300 which involves no credit check.

Which app is best for short loans?

There are several other apps that you can use for a short loan. They included

- PaySense.

- LazyPay.

- Bajaj Finserv.

- IDFC First Bank.

- ZestMoney.

- Dhani.

- HomeCredit.

- CASHe.

How can you get an immediate loan in 5 minutes?

Specta offers you loans up to 5 Million in one transaction and just in 5 minutes! You don’t need paperwork or visit the office. This may be good if you are going to start any business.

Wrap Up

I have tried to guide you by providing all the best possible ways to use loan apps that work with Cash App to avail of instant advance loans.

If you have any queries or confusion, leave us a comment in the below section I will try my best to respond.