Pakistan Asserts U.S. Sanctions May Not Apply to IP Gas Pipeline Project

By Newztodays Team

Pakistan said on Tuesday ruled out U.S. sanctions on the IP gas pipeline project at a stage of building a pipeline in its territory.

We are not connecting the IP gas pipeline project with Iran and I don’t think that U.S. sanctions can apply to the IP project at this stage,” Energy Minister Muhammad Ali said while addressing a press conference here on Tuesday.

He said that Pakistan would take around one and a half years to complete the IP gas pipeline project in its territory.

When asked about the U.S. sanctions on the IP project, the minister said that he did not know what the U.S. wanted regarding the IP project.

However, he maintained that currently, the work on 80km will be carried out, which will take one and a half years to complete. It will take time to connect it with the Iranian side for the supply of gas, he added.

While giving details, the minister said that Pakistan signed an agreement with Iran for a gas pipeline in the year 2009 and is bound to implement the gas project under the arrangement.

The caretakers are also going to leave the government for the upcoming government with a legacy of a gigantic circular debt of Rs 5.42 trillion.

The circular debt of the country’s energy sector has reached Rs 5.422 trillion, while the capacity payments to IPPs have reached Rs 2 trillion.

The minister said that currently, the principal circular debt of the petroleum sector stands at Rs 2300 billion, while for the power sector, it has accumulated to Rs 2400 billion.

With interest, the circular debt of the petroleum sector is Rs 3.022 trillion, which takes the total to Rs 5.422 trillion. However, he said that with various interventions undertaken by the interim government, the accumulation of the Circular Debt has been stopped.

In reply to a query, the official of the petroleum division said that the total overdue amount of the Chinese IPPs, under CPEC, is Rs 511 billion.

The power sector Circular Debt contained within the IMF target of Rs 385 billion for the end of December 2023, which has resulted in the stock settlement of 35% petroleum and 10% power sectors circular debt.

The anti-power theft campaign in all DISCOs was initiated in September 2023, which has resulted in Recovery increased by 2%, translating into Rs. 54.6 billion till January 31, 2024. The total impact amounts to Rs. 67.4 billion, he added.

Similarly, as a result of the campaign, line losses have decreased, translating into a benefit of Rs.12.8 billion, the minister claimed.

The minister said that the interim government has approved work on an 80-kilometer portion of the Iran-Pakistan Gas Pipeline project. On the capacity payments, an official of the Power Division informed that out of the total energy cost of Rs 3.2 trillion, around Rs 2 trillion is capacity payments to Independent Power Producers (IPPs).

Regarding the privatization of the state-owned Discos, the Minister informed that Cabinet approval has been received for private sector participation in the operations of two DISCOs (HESCO and GEPCO) through long-term concession agreements leading to the eventual privatization of DISCOs.

However, he said that no sale of government assets is involved in the process, which is backed by successful precedents in countries like Turkey, Argentina, Brazil, and Uganda.

The minister said that the Installation of approximately 700 km of optical fiber on transmission lines in the SCADA-III project completed by NTDC warned that without substantial investments in indigenous energy resources and energy efficiency measures, the nation could face a staggering expenditure of $60 billion on importing petroleum products within the next two decades, a significant leap from the current $17.5 billion.

The ministry emphasized the crucial need to ensure the availability of indigenous fuel through enhanced domestic production and refining to achieve affordable and secure energy.

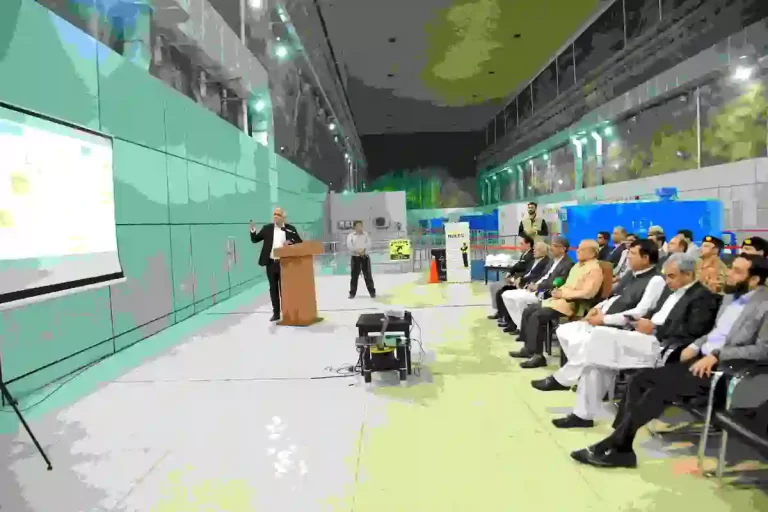

The caretaker minister for Energy Muhammad Ali while briefing media persons here about efforts to address the challenge, said the caretaker government introduced the Tight Gas (Exploration & Production) Policy 2024, focusing on an innovative pricing strategy to encourage efforts in exploring and producing unconventional hydrocarbon reserves.

The policy aims to invigorate existing exploration and Production (E&P) companies to intensify their exploration endeavors. Additionally, amendments to the Petroleum Exploration & Production Policy 2012 were made to adapt to changing market conditions and promote investment in the energy sector.

In a briefing, an official of the Petroleum Division said that efforts to revive dormant wells and reignite dormant discoveries have become vital strategies, with recent advancements emphasizing this approach.

Notable achievements include the injection of 152 million cubic feet per day (mmcfd) of gas, the drilling of 22 wells, and the revelation of 6 new oil and gas findings. Furthermore, on January 24, 2024, the government executed Petroleum Concession Agreements (PCAs) and Exploration Licences (ELs) for eight oil and gas blocks.

The Cabinet Committee on Energy (CCoE) recently approved additional enhancements to the current brownfield refining policy, aimed at encouraging local refineries to undertake upgrading projects.

Incentives have been extended, including funds covering 27.5 percent of project costs and a tariff protection mechanism. These measures seek to provide financial and regulatory support to incentivize refinery upgrades and enhance overall sector efficiency.

The revised refining policy is anticipated to facilitate a $6.5 billion investment in upgrading five local refineries, leading to the production of environmentally friendly Euro-V-compliant fuels and a significant increase in local production capacity.

In efforts to bolster domestic gas production, Pakistan anticipates adding 280 million cubic feet per day (mmcfd) by the end of the calendar year 2024. A comprehensive strategy has been devised to tap into various reserves across the nation, with key milestones already achieved.

Additionally, Pakistan’s energy sector is advancing with key projects underway, including the Iran-Pakistan Gas Pipeline Project (IP) and the Pak-Stream Gas Pipeline Project (PSGP). Efforts are also ongoing to establish Strategic Underground Gas Storages (SUGS), enhancing energy security and infrastructure. MoU Seals Consortium for Machike-Thallian-Tarujabba White Oil Pipeline Project

The recent greenlighting of recommendations by the Ministerial Oversight Committee signals a commitment to advancing energy projects, with a focus on the initial 80km segment of the pipeline within Pakistan.

The project, managed by ISGS and funded through GIDC, is set to extend from the border to Gwadar in the first phase. The ministry also mentioned recent developments in Pakistan’s mineral sector including significant discoveries following geophysical surveys and chemical analyses.

A memorandum of understanding (MoU) worth $200 million has been signed between PMDC and Miracle Salt, USA, focusing on Pink Salt processing. Agreements with China, UAE, and Kuwait aim to attract investment in mineral exploration.

Additionally, agreements for copper and rare earth metals mining with Kuwait have been pursued. On new gas connections, the official of the Petroleum Division informed that SNGPL has been allowed to give new imported LNG-based gas connections to housing societies.

Around 15,000 new connections will be provided to around 300 societies, he added. There are three million applications for new gas connections pending with SNGPL, the official informed.