KSE 100 Index Gains on Tax Stability and Positive Economic Indicators

KSE 100 Index extended its gain as the index gained to make an intraday high of 1,102 points, as no increase in tax rate on dividend and capital gain from stock market for filers against market rumors and increase in taxes on other asset classes continue to garner investor interest in the market. Some intraday profit taking was observed during the latter part of trading session,Pakistan Budget FY25 – Stock market measures; Positive for market

as investors preferred to book their profit before the long weekend on account of Eid al Adha holidays. Major positive contribution to the index came from banks, as MEBL, MCB, BAFL, UBL, BAHL and HBL cumulatively contributed 642 points to the index. Traded volume and value for the day stood at 395mn shares and Rs21.33bn respectively. KEL was today`s volume leader with 23mn shares.Economic Survey 2023-24: Industrial and Services Sectors Show Growth

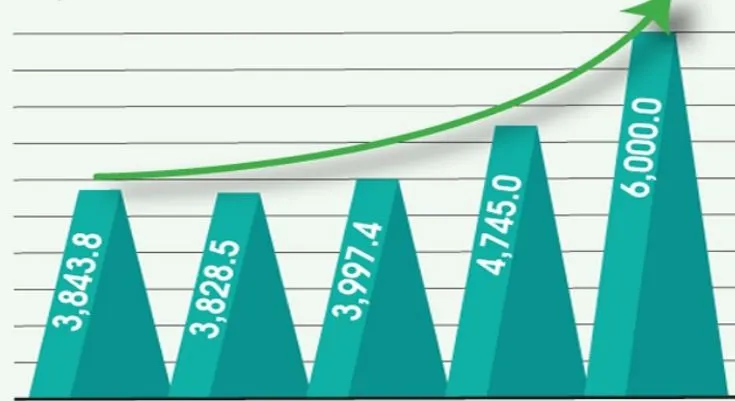

KSE 100 Index gained 4% on WoW basis, this positivity in the market can be attributed to Federal Budget FY25 which was better than market expectations; tax rate on dividend and capital gain from stock market for filers was maintained whereas there was increase in tax on dividends from mutual fund deriving more than 50% income from profit on debt and increase in CGT from 3% to 15% on property. Decline in policy rate by 150bps in monetary policy meeting on Monday by SBP also provided stimulus to the market.

Other major developments during the week were: 1) Pakistan Auto sales (as reported by PAMA) clocking in at 10,949 units in May 2024, the highest after 15 months up 4% MoM and 100% YoY and 2) T-Bill auction held during the week, where yields declined in the range of 85-115bps across different tenor. Average traded volume and value during the week stood at 410mn shares and Rs16.9bn respectively.