Naya Pakistan Housing Loan-All You Need to Know

Ibn-e-Ameer

Everyone dreams of having their own house. In Pakistan, there is a shortage of 12 million housing units. A large part of the population has no houses and lives on rent. The government had started a project to provide homes under the Naya Pakistan housing loan. The article provides details of the project and the process of availing housing loans under the Naya Pakistan Project.

What Is Naya Pakistan Housing Loan Scheme?

Prime Minister Imran Khan had launched Naya Pakistan Housing Loan Scheme to provide 5 million housing units.

The purpose was to focus on low-income groups especially those who are underserved. This is part of the government’s socio-economic development program.

The other objective was also to boost construction activities and job opportunities.

The current status

Pakistan Housing Authority (NPHA) has received more than 70,000 applications to secure housing loans amounting to Rs 125 billion.

The government had distributed Rs 38 billion had been distributed among 12,000 people.

The spokesperson for the Naya Pakistan Housing Authority (NPHA) had informed the media.

Spokesperson Asim Shaukat talked during information conversation that the government had built 20,000 houses so far.

The authority had built and distributed these houses.

He added they were building houses in Alipur Farash. The authority was going to kick off work o the project in Sangjani.

The idea is to build and distribute affordable housing.

The government is making efforts to reduce the amount of the loan for housing installment in Pakistan.

The objective is that it should not exceed the normal rent amount, he added.

He added that the authority was trying to ensure banks should not charge any processing fees.

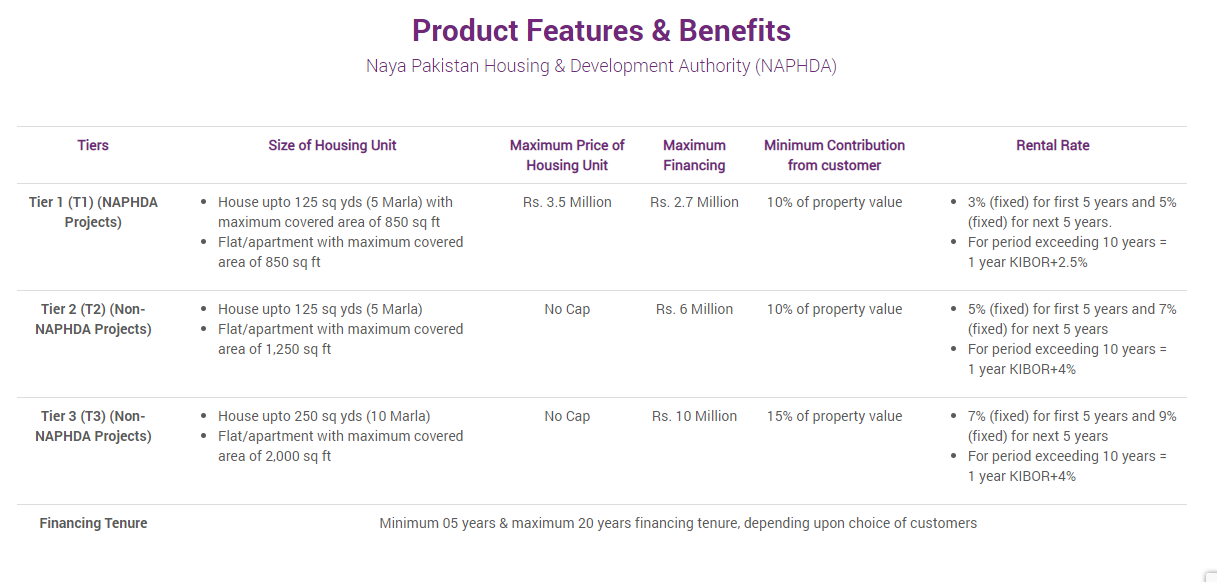

Under the Naya Pakistan housing project, loans will be available at 5% interest in the first five years.

Banks will provide loans at 7% in the second five years.

The authority has announced now to make registration without any processing charge.

It has also announced to make online registration to avail housing loan under Naya Pakistan Project.

How to Apply Naya Pakistan Housing Scheme Loan and Process

Earlier, the process of availing Naya Pakistan Housing Scheme Loan was difficult.

However, the government has now simplified it to target low-income groups. This will help them avail Naya Pakistan Housing Loans easily.

The new Application form is very simple. You need to provide details of your name, father’s name, CNIC numbers, and residential address.

After receiving forms, banks officials would assess loan applications for housing under Naya Pakistan.

They will evaluate the power utility bills of applicants. They will also examine properties in which the applicants lived on rent.

Even a rickshaw driver can qualify for the loan if he proves to save as much as Rs15,000 a month.

State Bank of Pakistan had approved a new form for housing loans.

Banks will also seek proof of employment and income.

Eligibility Criteria

CitizenShip

All Pakistani nationals who were either resident or non-resident and hold CNIC/NICOP can avail of the loan.

Home Owner

The first-time homeowners will be eligible and qualify for housing loans.

Housing Finance Facility

The government has decided to offer this housing finance facility to a person only once in a life.

Units to be Financed

The banks will provide financing for the construction and purchase of housing units.

Collateral Security Requirement

Trust will bear responsibility for the title documents under NAPHDA Projects.

The government will mortgage housing units in favor of financing banks for Non -NAPHDA Projects under Banks’ credit policy.

Age of Housing Units

This will also apply to newly constructed housing units during last year from the date of application.

However, this requirement will not apply till March 31, 2023, under Tier 2 and Tier 3.