TRG Pakistan has decided to buy back its shares through Special Purpose Vehicle (SPV).

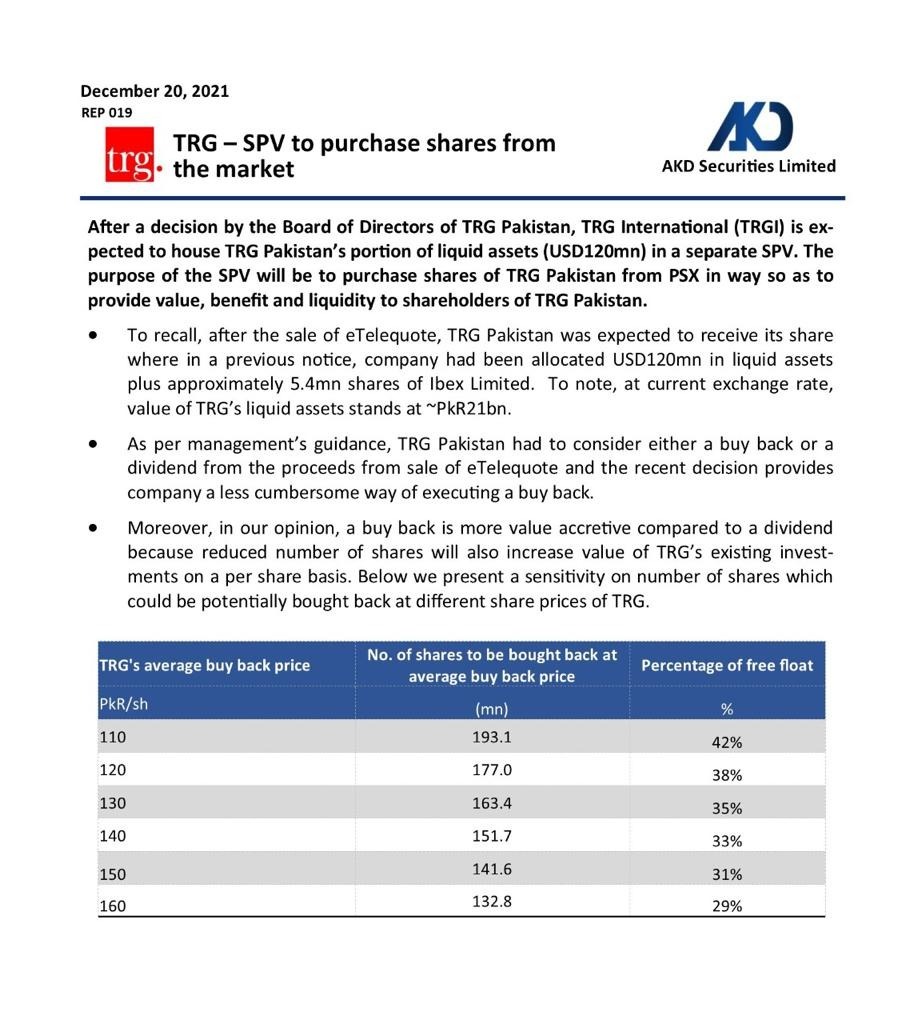

After a decision by the Board of Directors of TRG Pakistan, TRG International (TRGI) is likely to house TRG Pakistan’s portion of liquid assets worth USD 120 million in a separate SPV.

The purpose of the SPV will be to purchase shares of TRG Pakistan from PSX in a way that provides value, benefit, and liquidity to shareholders of TRG Pakistan.

To recall, after the sale of eTelequote, TRG Pakistan was likely to receive its share wherein a previous notice, the company had been allocated USD120 million in liquid assets plus approximately 5.4 million shares of lbex Limited.

At the current exchange rate, the value of TRG’s liquid assets stands at Rs 21 billion.

As per management’s guidance, TRG Pakistan had to consider either a buyback or a dividend from the proceeds from the sale of eTelequote.

The recent decision provides the company with a less cumbersome way of executing a buyback. Moreover, a buyback is more value accretive compared to a dividend because a reduced number of shares will also increase the value of TRG’s existing investments on a per-share basis.

Earlier, TRG Pakistan Limited management had discussed the prospect of a bumper dividend or share buyback from the proceeds of its stake sale in eTelequote Limited during an investor briefing session.

TRG International Limited (TRGIL) holds 70% of eTelequote, while TRG Pakistan holds 45.3% of TRGIL.

Become aware that eTelequote Limited is worth approximately $600 million in enterprise value and it has a value of $450 million after the debt is paid. TRG Pakistan Limited announced that TRGIL would get the consideration of $309 million after post-consolidation expenses and other things were deducted.

According to a PSX filing, TRG Pakistan’s share after debt adjustment at TRGIL will be roughly Rs. 21.5 billion, and today, Zia confirmed that TRG Pakistan will have the right to USD105 million of the amount received from the eTelequote disposal. The time came for Pakistan to determine whether to pay a dividend or buy back its shares.

Zia Chishti-CEO, TRG Pakistan Limited

Afiniti plans to have its initial public offering in 2022, but there are still difficulties that need to be addressed first.

This year’s revenue is estimated at USD237 million, with a CAGR of 75%. It had a market valuation of $2.1 billion and its current debt was $335 million. The investors were unique, with Afiniti being the only firm that qualified.

C3.ai and Palantir can assess Afiniti’s valuation.

C3.ai and Palantir are trading at 35 and 41 times revenue for 2021 and 25 and 32 times revenue for 2022. Zia has declared that TRGIL has no future investment intentions and that the money would be used to repay investors who have placed their trust in us over the last 15 years.

To recall, the company posted a Net Profit of PKR 7,226mn (EPS: PKR 13.25) in 9MFY21 against PKR 19mn in SPLY.

Read More: TRGIL to sell its full stake in E-telequote

The given company received a larger profit-in-equity share of PKR 8,413mn. Currently, TRG Pakistan Limited has a 43% holding in TRG International (TRGI). While TRGI has 37.9%, 63.5%, and 70% stake in Afiniti, Ibex, and e-Telequote, respectively.

During 6MFY21, the company’s subsidiaries Afiniti and e-Telequote had an annualized revenue of USD 237mn and USD 193mn, respectively, with a historical growth rate of 75% and 52%, respectively. Whereas in 9MFY21, Ibex (another subsidiary) posted annualized net sales of USD 446mn.

The company’s subsidiary, e-Telequote, is expected to be sold to a USA-based company; the transaction may be finalized soon by Jul-Aug’21. The subsidiary’s enterprise valuation as per the company is USD 455mn (after deduction of net debt).

TRGI (Bermuda) shall control the sales proceeds. During 9MFY21, the company successfully listed Ibex Global on Nasdaq.

The new office of a subsidiary Afiniti has now been set up in Beijing, China, after an office was established in Hong Kong. With

This is why the company aims to tap into the huge Chinese market. Upon a question about the announcement of a 15% technology tax by the G7 countries, the company explained that since it is based in

In Bermuda, this will have an impact on the company’s earnings. However, the company does not see the implementation of this in the coming 4-5 years. As per company management, TRG was impacted by COVID-19 as the lockdown limited call center services.

Customer calls increased significantly by 20%-40% and benefited the company post lockdown as customers preferred more home services instead of going to the market in person. Regarding the question of a 5-yr plan, the company stated that it has no plans to make further investments.