U.S, KMB invest $25m for Women empowerment, microbusinesses

In order to support Pakistan’s leading financial institution, Khushhali Microfinance Bank Ltd. (KMBL), and women-owned businesses, the U.S. government, through the U.S. International Development Finance Corporation (DFC) and the U.S. Agency for International Development (USAID), has entered into a new partnership.

Through their alliance, MSMEs would have better access to financing with lenient collateral requirements. A $25 million investment guarantee offered to KMBL by DFC in partnership with USAID/Pakistan has enabled the completion of this project.

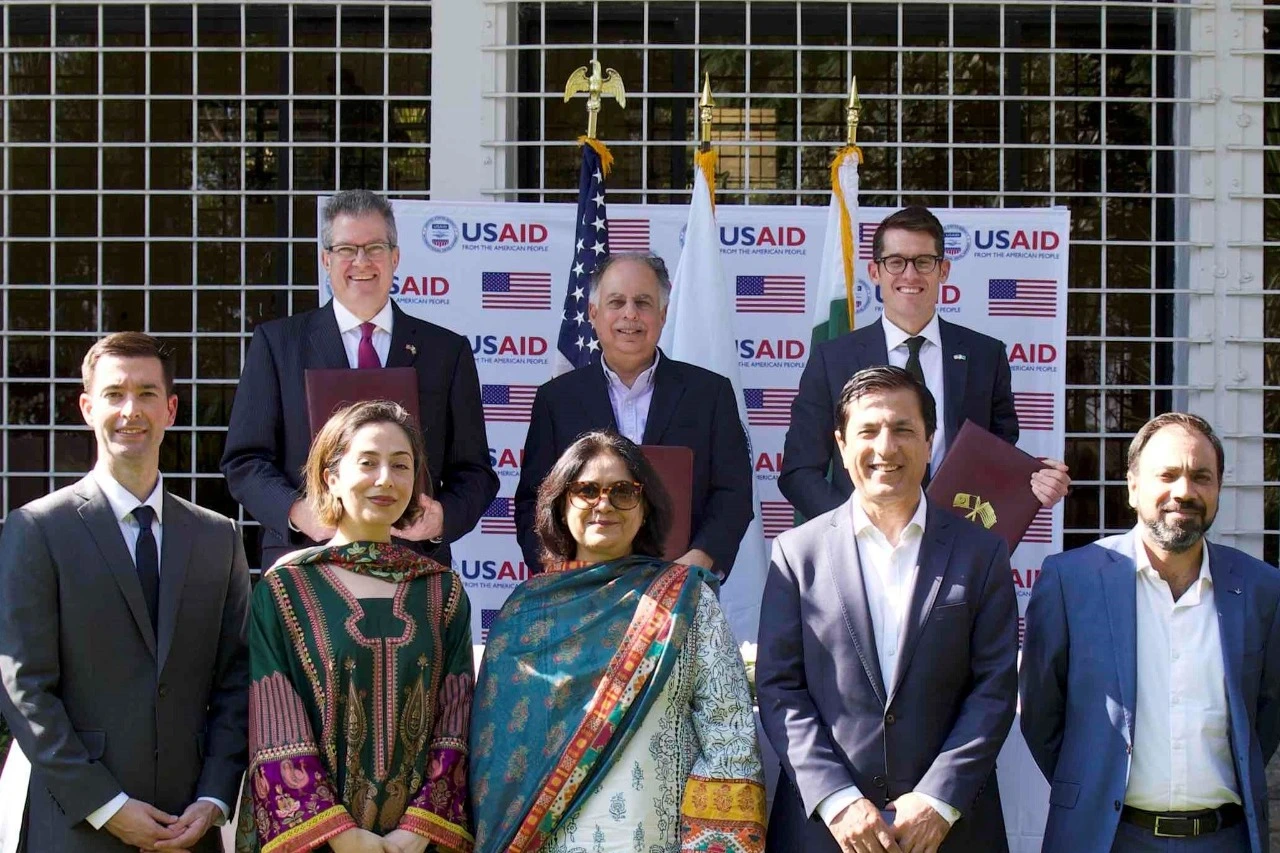

Jake Levine, the Chief Climate Officer for DFC, Michael Rossman, the Acting Mission Director for USAID/Pakistan, Ghalib Nishtar, the President of KMBL, and other high-ranking officials from the U.S. government and KMBL attended the launch event.

DFC has given KMBL a $10 million, 50% loan portfolio guarantee so that it can mobilise commercial loans for 2X-qualified MSMEs that are primarily owned, operated, or staffed by Pakistani women throughout the nation. In enterprises that are owned by women, directed by women, or offer a good or service that empowers women, DFC’s 2X Global Women’s Initiative has sparked more than $13.5 billion of gender-smart investment.

KMBL received a $15 million, 50 percent loan portfolio guarantee from DFC as well. This will help the bank attract commercial loans, particularly for MSMEs doing business in Khyber Pakhtunkhwa Province and its newly combined districts (NMDs).

According to Michael Rossman, acting mission director for USAID, “U.S. government initiatives, such as these loan guarantee facilities, are playing a key role in unlocking private financing for small and medium-sized businesses and women entrepreneurs and advancing the U.S. government’s long-term commitment to helping Pakistan secure a more prosperous future.”

“Today’s agreement highlights DFC’s commitment to supporting the resilience of small enterprises that enhance lives and facilitate equitable growth and employment,” said DFC Chief Climate Officer Jake Levine.

“This funding will help small businesses in Pakistan adjust to the effects of the climate crisis by providing financing to support firms in areas affected by the most recent floods as well as those that increase access to new mitigation solutions.”US Delivers Additional 8 Million Pfizer COVID-19 Vaccine Doses

The DFC’s confidence in KMBL’s high standards was acknowledged by KMBL President Ghalib Nishtar, who added that “These loan portfolio guarantees will build capacity and create more opportunities for KMBL to empower micro and small businesses, especially those owned by female entrepreneurs, to contribute in the socio-economic uplift of the country.”

MSMEs produce 80% of the non-agricultural jobs in Pakistan and contribute more than 30% of the country’s GDP, according to research, although they only account for 6.3% of all private sector credit.

In Pakistan, there are about 8% of MSMEs are owned and operated by women, yet they have a $3.5 billion funding shortfall. Loan guarantee arrangements allow financial partners to transfer some risks that they might otherwise find difficult to absorb or manage on their own, which aids in the mobilization of resources to support neglected populations and regions.