FBR Tax Revenue Falls Short by Rs199b in Quarter

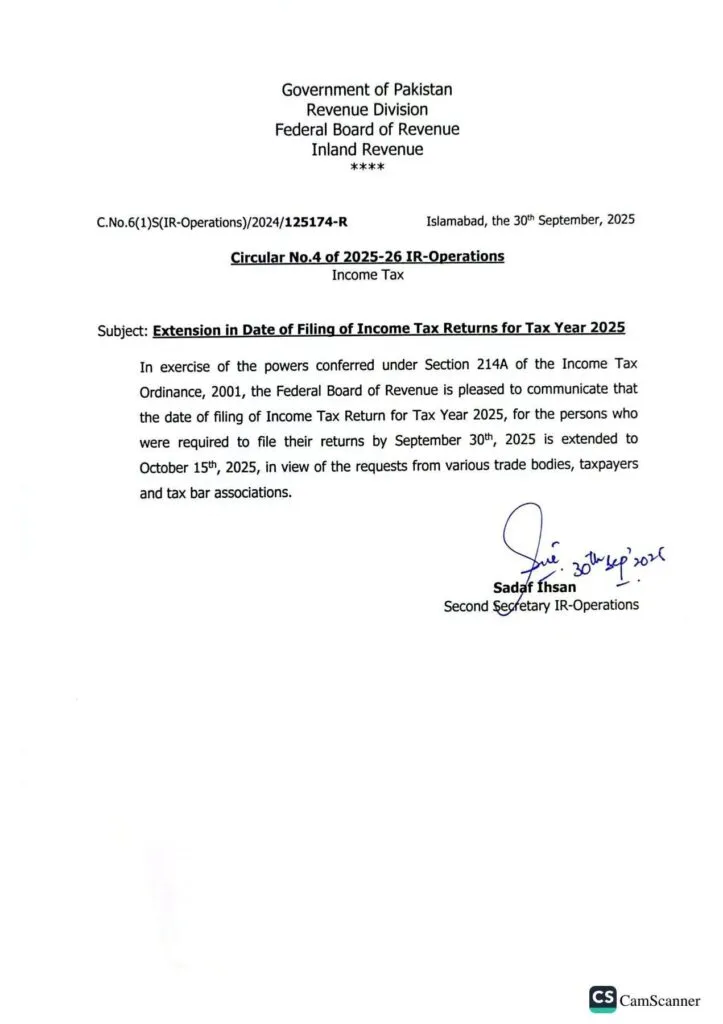

FBR Extends Tax Return Submission date Till October 15, 2025.

FBR tax revenue recorded a major shortfall of Rs156 billion in September alone, as devastating floods hampered business activity across multiple regions.

According to official data, the Federal Board of Revenue missed its July–September collection target by Rs199 billion, falling below Rs3,083 billion to Rs2,885 billion.

During the quarter, the tax authority disbursed refunds worth Rs157 billion, further impacting net revenue, according to sources familiar with the financial performance review.

Collection breakdown showed Rs1,395 billion from income tax, Rs1,130 billion from sales tax, Rs190 billion from excise duty, and Rs324 billion from customs duty.

Officials estimated that the floods reduced tax revenues by nearly Rs60 billion, highlighting the severe economic impact of climate-related disasters on national financial performance.

Read More: FBR Revises Tax Form, Adds Asset Value Details

Meanwhile, the FBR extended the deadline for filing income tax returns until October 15, allowing citizens additional time to comply with tax obligations.

The authority confirmed in a notification that income tax return forms are available online, enabling taxpayers to complete submissions through a simplified digital system.

Earlier, September 30 was announced as the deadline, but the extension followed demands from the business community and widespread delays in return filing.

Sources disclosed that nearly 400,000 individuals had filed their income tax returns, with many more expected to benefit from the two-week extension period.

The government described the move as a major relief for taxpayers, ensuring compliance while addressing concerns raised by business groups across Pakistan.