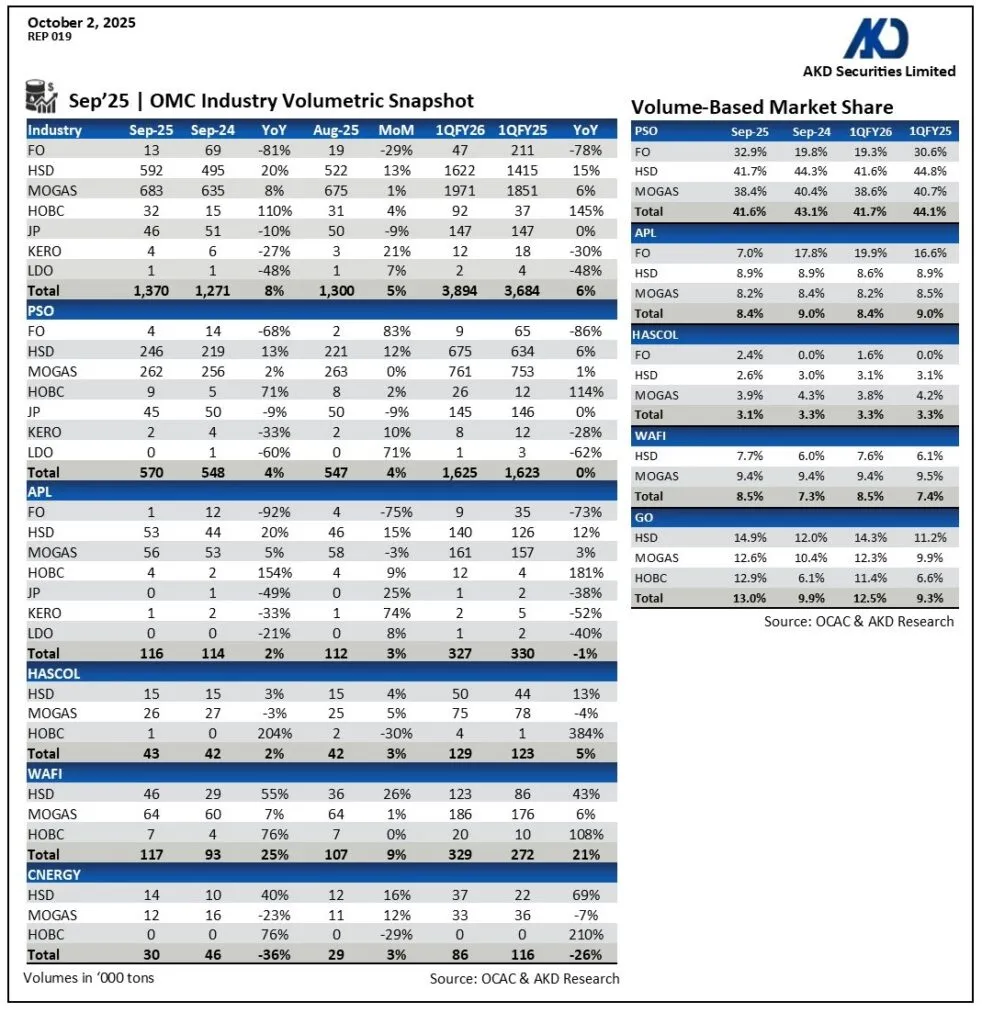

Pakistan’s Oil Marketing Companies (OMCs) recorded sales of 1.4 million tons in Sep 2025, up 8% YoY and 5% MoM.

The YoY growth was supported by gradual economic recovery and reduced smuggling from Iran, while the MoM increase was driven by a lower base as sales in Aug were lower than potential due to floods and monsoon rains all over the country.Govt to finance 26% in refineries upgradation projects

This takes total sales for 1QFY26 to 3.9mn tons, reflecting a 6% YoY increase compared to 3.7mn tons in 1QFY25.

Excluding Furnace Oil (FO) sales in Sep 2025 were 1.36 million tons, reflecting a 13% YoY and 6% MoM rise. For 1QFY26, Ex-FO sales totaled 3.8mn tons, an 11% YoY rise.

Motor Spirit (MS) prices remained stable at Rs264.61/litre, while High Speed Diesel (HSD) prices fell by 3% from an average of Rs279.41/litre to Rs271.38/litre.

Product-wise Sale

MS sales saw an 8% YoY and 1% MoM increase to 683k tons in Sep 2025. Similarly, HSD sales rose 20% YoY and 13% MoM to 592k tons.

FO sales for Sep 2025 fell by 81% YoY and 29% MoM to 13k tons. CYNERGY, Pakistan State Oil (PSO), and Pearl PARCO were the main sellers for FO this month.

APL

Among listed entities, Attock Petroleum’s (APL) sales stood at 116k tons in Sep 2025, up 2% YoY and 3% MoM on the back of higher HSD sales. APL has a market share of 8.15% in MS and 8.94% in HSD, down 39bps while up 14bps respectively in Sep 2025.

PSO

PSO saw a rise of 4% YoY and MoM to 570K tons in Sep 2025. PSO’s market share in MS and HSD clocked in at 38.35% and 41.66%, down 62bps and 63bps MoM, respectively in Sep 2025. PSOs’ overall market share rose from 42.07% in Aug 2025 to 41.57% in Sep 2025, down 50bps, primarily led bya decrease in MS market share.

Wafi

Wafi Energy Pakistan Limited (WAFI) recorded sales of 117k tons in Sep 2025, up 25% YoY and 9% MoM. While HASCOL’s sales reached 43k tons, up 2% YoY and 3% MoM.

FY26 Outlook

We expect oil sales in FY26 to grow in the range of 7-10%,” Topline said.

The government has set a Petroleum Development Levy (PDL) collection target of Rs1.47trn for FY26, of which Rs357bn (24%) has been collected in 1QFY25, we believe.