Gold rose on Tuesday after surpassing the $5,100 mark in the previous session, as geopolitical uncertainty and safe-haven demand drove investor interest in precious metals globally.

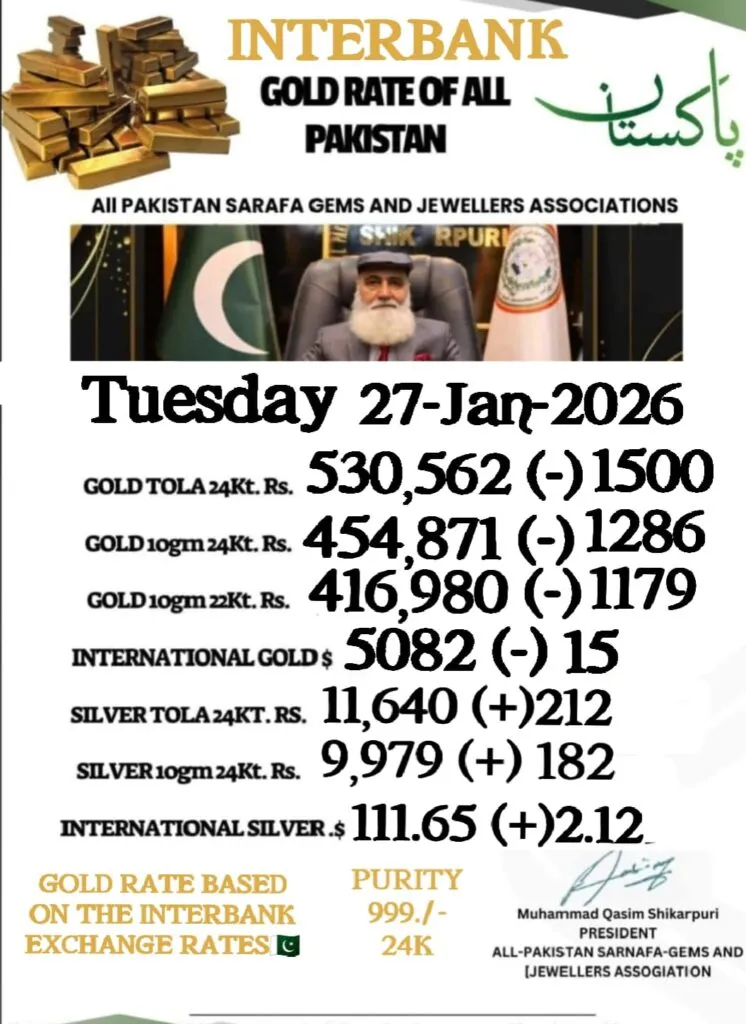

Spot gold climbed 0.9 per cent to $5,060.36 per ounce, following a record $5,110.50 on Monday, while US gold futures for February delivery eased 0.5 per cent.

Tim Waterer, KCM Trade’s chief market analyst, said President Trump’s disruptive tariffs on Canada and South Korea were boosting gold’s appeal as a defensive investment choice for traders.

Read More: Nigehban Cards to Deliver Ramadan Relief

China’s Zijin Gold announced plans to acquire Canada’s Allied Gold for $4.02 billion in cash, reflecting record-high prices that have increased mining margins and fueled industry consolidation efforts.

Spot silver jumped 4 per cent to $108.05 per ounce after hitting a record $117.69 on Monday, while platinum fell 4 per cent and palladium declined 1.4 per cent.

A weakening dollar caused by US government instability, Fed leadership uncertainty, and interventions to stabilize the yen further supported gold prices, making the dollar-priced metal cheaper for international buyers.