Are Payday Loans in Murfreesboro TN Best-Debt Solution?

By Newztodays Team

Are you looking for Payday Loans in Murfreesboro TN and believe they offer the best debt Solution?

There are Numerous payday lenders are based in Murfreesboro, Tennessee. These Murfreesboro finance companies automate the collection of your loan payments, which they subsequently distribute over time.

Payday loans should only be taken out in case of emergency or sudden need for extra money as they are not a good long-term debt solution.

Customers on a budget might not be aware of all the options available to them. A vast variety of short-term lending businesses can be found in cities like Murfreesboro.

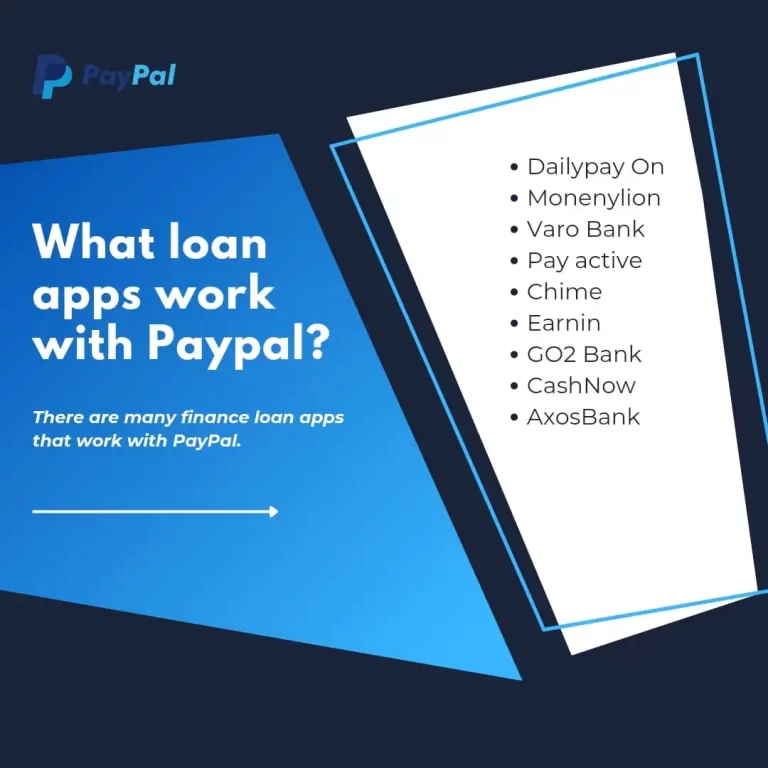

It’s vital to know where to look. Get more about locating a lender in your area by reading on. Loan Apps that work with Cash App

How do payday loans and cash advances operate in Murfreesboro?

With payday loans, you can take out a short-term, small loan and pay it back with your next paycheck. Online loan applications are accepted instantly, and funds are disbursed within one business day.

You can also apply for a loan by going to one of our Murfreesboro payday loan locations. In less than 30 minutes, you could receive up to $1,000 if you are approved.

You will likely be approved for a loan in Murfreesboro if you meet the requirements and have a reliable source of income.

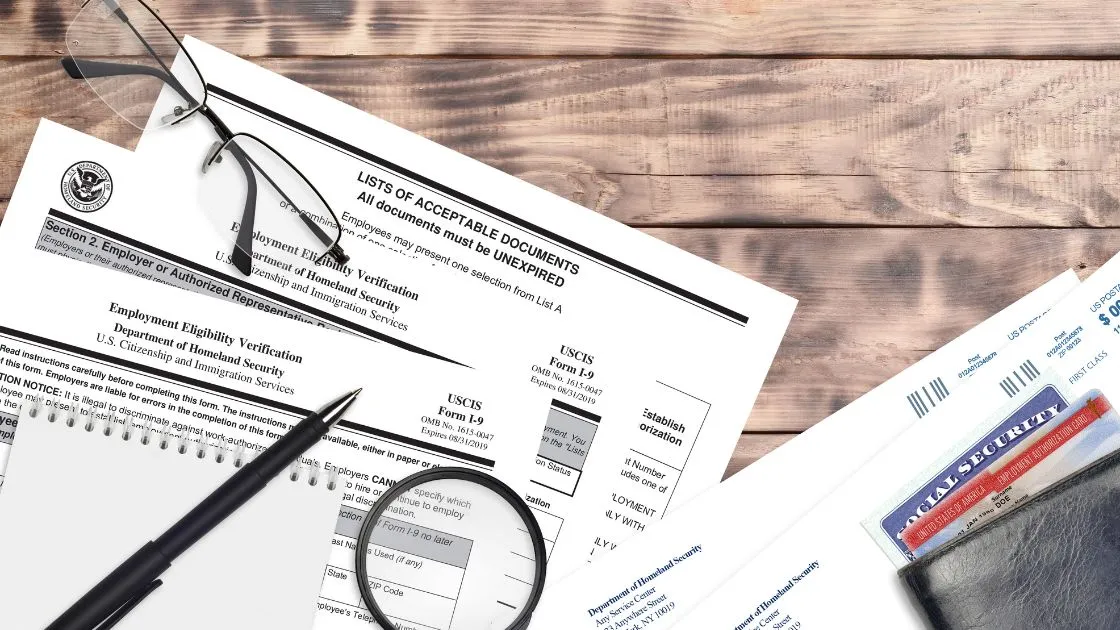

Eligibility requirements

There are a few eligibility requirements to meet when applying for payday loans in Murfreesboro TN. The criteria are mentioned below:

- A borrower must have a minimum of eighteen years old.

- You must have to provide your Social Security number.

- A driver’s license or picture ID issued by the government.

- The number on your checking account.

- The routing number of your bank is needed.

- Your proof of income is an essential requirement.

Note that the eligibility criteria mentioned above are the basic requirements asked by almost every lender. However, these requirements may vary from lender to lender.

Application Process of Payday Loans in Murfreesboro TN

The working process of payday loans is given below:

- Using the sliders, choose a loan amount between $100 and $35,000.

- Complete the short online form using a browser on any device.

- Find out in a matter of minutes if a lender has connected with you on screen.

- Fill out the application straight from the lender’s website.

- The lender will require personal information from you.

- These can include identification and address verification, your credit history, and any other information the lender might need.

- If accepted, the money could appear in your account within a single business day.

Murfreesboro Title Loan Requests

Title loans for cars represent an additional means of obtaining quick money. Collateral serves as security for this short-term loan.

Because the borrower backs the loan with their car, the lender bears less of the risk when considering an application.

Clients can continue to drive their cars while repaying a title loan. The vehicle is owned by the borrower during the repayment period, even though the lender technically takes ownership of it during that time.

After the loan arrangement is completed, the borrower ought to keep complete ownership of the car.

Not every state permits you to take out a loan against your car. Verify that the product is still available before applying for a title loan in Murfreesboro.

Who Can Benefit from Bad Credit Loans?

It’s likely that you have been rejected by banks and major lenders and do not have access to other credit options, such as credit cards if you are looking for bad credit loans.

If so, one of the greatest options for borrowing money in Murfreesboro, Tennessee, is a bad credit loan.

Anyone who wants quick cash but doesn’t want to go through the lengthy application and approval process required by most larger banks and lenders can also get a payday loan online.

Things to Do in Murfreesboro, Tennessee, If You Can’t Get Payday Loans

Applications for payday loans may be rejected for several reasons. These may consist of your gross income, credit score, or other conditions imposed by the lender.

Since these rating factors can be improved over time, there is no need to be alarmed when this occurs.

It’s crucial to speak with the lender if your application is rejected to learn why. This will assist you in determining which of the requirements in your profile are not met and in what ways you can meet them.

For example, whereas some lenders have lower credit score requirements, some may require a higher credit score than you have.

It is advisable to wait to reapply for a loan until you have determined the reason(s) behind your denial and taken the appropriate action to resolve the matter.

How to Search Online for a Reputable Direct Lender in Murfreesboro, TN

In Tennessee, a lot of people are trying to find a reliable direct lender. There may be fewer lenders in some places than in others, so individuals may be searching for a reputable business.

Finding a business that can provide loans to help you obtain the money you require is always best accomplished through research.

In Tennessee, credit reports are crucial when looking for a new lender. Paying off any debt you may have or making sure that it is paid on time each month is a great way to raise your credit score without having to spend any money.

Your provided information is significant. Verify that the information you have provided to the lender is accurate and that you are being honest.

It is ideal for everyone in Murfreesboro, Tennessee who might require assistance.

Final Thoughts

To conclude, people have most likely been looking for Murfreesboro, Tennessee Bad Credit Loans.

Contrary to popular assumption, being turned down does not preclude you from applying for loans. It merely implies that you have fewer choices.

If you’ve had financial difficulties in the past, it could be quite difficult to obtain a loan in Murfreesboro from a bank or other traditional lender.

However, in just a few minutes, you might be in contact with local lenders using the straightforward online form.

Moreover, do your homework before applying for such kind of payday loans in Murfreesboro TN.

Look at all the possible aspects and then decide whether it will be suitable for your condition or not. Now it’s totally up to your choice.