Assets’ control of PGPCL’s terminal set aside

Aftab Ahmed

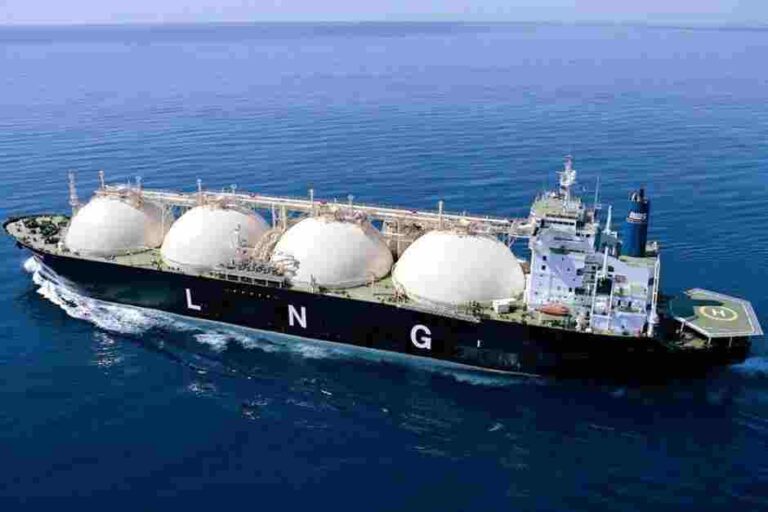

Islamabad: Cabinet Committee on Energy (CCOE) is set to consider two options for taking over assets of the second LNG Terminal owned by PGPC.

The Lahore-based business tycoon Iqbal. Z Ahmed is a major shareholder of the second LNG terminal.

Petroleum Division in a summary moved to Cabinet Committee on Energy (CCOE) scheduled to meet on Thursday has proposed different options to take over assets of second LNG Terminal.

In order to secure the LNG supply chain, the Petroleum division claims that the Operations and Services Agreement (SSA) provides PLTL the right upon expiry or earlier termination of OSA, to purchase, lease the services infrastructure.

Under one option, it has been informed to the cabinet body on energy that PLTL may purchase the Jetty aside FRSU from PGPCL. Other options are lease of floating storage and re-gasification from BW, connecting pipeline and their Jetty from FOTCO, and novation of PQA Implementation Agreement from Port Qasim Authority (PQA).

Under second option, Petroleum Division has proposed that as an alternate to take over the operations of second LNG terminal by PLTL, OSA also provides for appointing substitute operator through a transparent competitive bidding process. This option ensures that original mandate is preserved and public-private partnership is promoted and continued.

Option and direct agreements, ancillary to OSA have been signed by PLTL with the project parties-BW, PQA, and FOTCO to execute these rights. In order to continue the smooth supply of LNG, PLTL in January this year issued an Option exercise notices to purchase and lease the services Infrastructure. According to PLTL, they have executed their contractual right to restore the confidence of international investors.

Petroleum Division informs that M/S Ernst and Young was engaged by PLTL for financial due diligence and subsequent project financing for acquisition of assets of Terminal-2.Total funding required for the project is Rs 13.5 billion. The project will be financed through mix of 65.35 debt and equity ratio which will be required an equity injection of Rs 4 billion whereas Rs 8.8 billion would be raised from commercial banks.

According to PLTL, from the financial due diligence of the consultant, a project is commercially found viable with an IRR of 26 percent with a manageable risk and payback period. PLTL had further informed that there was the potential of passing on the benefit to the public because of levelized tariff of 38.67 cents per MMBtu.

In order to set up a second LNG terminal, PLTL entered into operations and services agreement (OSA) with PGP consortium Limited (PGPCL) on July 1, 2016, for a period of 15 years to provide and perform LNG services to PLTL.

Due to PGPL’s failure to meet their contractual deadlines to commence terminal operations on commercial start day of July 1, 2017, PLTL imposed liquidity damages to the tune of $30 million on September 25, 2017.

The PGPL gave a revised commercial date of November 28, 2017. However, PGPL failed to start commercial operations on a given date and PLTL imposed another penalty of $11.1 million in addition to imposing $9.485 million on account of gross negligence and willful misconduct of PGPL.

Both parties PGPL and PLTL initiated a dispute resolution mechanism. Clause 3 of OSA provides that any dispute between parties should be referred to the authorized representatives for amicable settlement within 90 days and if the dispute is not settled, then it would be finally settled through binding international arbitration. The dispute ended in February without resolution. In the matter on March 4, 2020, PGPL filed a request for international arbitration.

Furthermore, due to delay for more than one year in the provision of adequate assurance of performance financial guarantee of $15 million, PLTL terminated the OSA on October 14, 2019.

PGPL again opted for dispute resolution which ended on January 23, 2020, including an extended period of 10 days. PGPCL on January 22, 2020, filed an arbitration petition in Islamabad High Court praying for the court to refer the matter to international arbitration. On January 31, 2020, PGPCL also filed a request for international arbitration at the London Court of International Arbitration (LCIA).

Pending the outcome of dispute resolution, both parties are obligated to perform their respective obligations thus ensuring commitment of operations of the terminals. The matter of appointing legal counsel for international arbitration is under consideration by the attorney general of Pakistan.