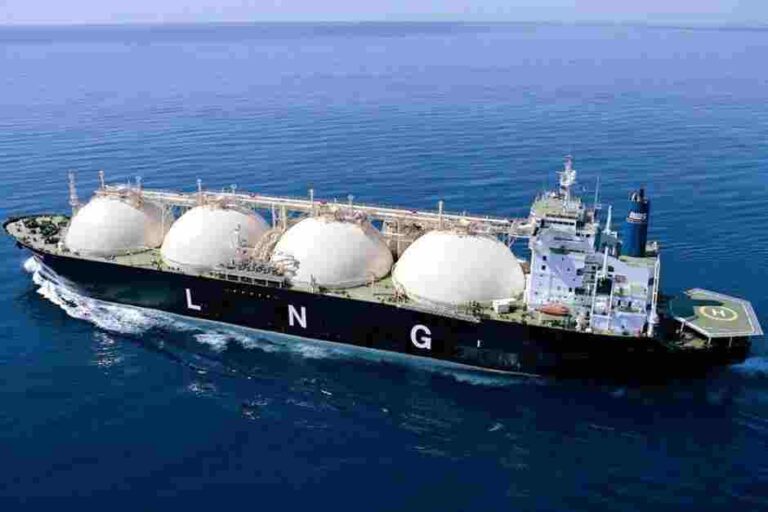

Saudi Arabia to build LNG terminal in Pakistan

Abn-e-Ameer

Islamabad: Saudi Arabia is likely to set up an onshore LNG terminal in Pakistan to export gas in a bid to capture the market.

Pakistan has two offshore LNG gas terminals. So, Saudi Arabia will be the first country to build an onshore terminal in Pakistan with an objective to export gas to Pakistan.

At present, Qatar has captured the market as it is exporting LNG to Pakistan. It is currently exporting 500 mmcfd gas to Pakistan to meet the requirement of power, CNG, industry, and power sectors.

Pakistan has two offshore LNG terminals. So, Saudi Arabia will be the first country to build an onshore terminal in Pakistan.

Qatar is exporting gas but it has not made any investment in setting up an LNG terminal. It had shown interest earlier to build an LNG pipeline but could not materialize the plans in this regard.

Sources told Newztodays.com that Prime Minister Imran Khan is likely to visit Saudi Arabia by end of the current holy month of Ramadan.

During a visit, two sides will discuss establishing an LNG terminal in Pakistan.

Saudi Arabia is the only country in the Middle East that had given deferred oil payment facility worth $3 billion to Pakistan in different tenure. It had also announced in October 2018.

Pakistan has been a traditional market of crude oil for Saudi Arabia for decades. However, the PML-N government in the year 2015 had commissioned the first LNG terminal in Pakistan.

It had also signed a long-term LNG deal with Qatar at 13.37 percent of Brent oil that had also sparked controversy due to the price revision clause.

The previous government, Pakistan State Oil (PSO) had also signed an LNG deal with private firm Gunvor for export of 100 mmcfd LNG at the same price of $13.37 percent of Brent oil. It was for five years term that expired in December 2020.

Pakistan LNG Limited (PLL) had also signed LNG deals with two LNG firms which included Italian firms ENI and Gunvor for long and short terms respectively.

The Pakistan LNG market has been lucrative for different countries like Russia, Oman, China, and Malaysia. These countries have been trying to win LNG contracts.

Amid this situation, there has been competition in the LNG market. Saudi Arabia had entered into a race of winning LNG contracts.

Soon after announcing the bailout package for Pakistan which also included crude oil deferred payment facility, it started pressing Pakistan to import LNG.

However, Pakistan did not agree to import LNG which resulted in cutting crude oil imports almost to half on deferred payment. The other reason was that Pakistan and Saudi Arabia’s relations entered the cold era.

Saudi Arabia is still keen to export LNG to Pakistan and therefore wants to set up LNG terminal in Pakistan.

Competition

Pakistan has two LNG terminals with a combined capacity of 1.2 billion cubic feet per day (bcfd). Two new companies-Energas and Tabeer Energy are also working on setting up two more LNG terminals in Pakistan in the same capacity. Tabeer Energy, a subsidiary of Mitsubishi, is setting up an onshore terminal.

The dynamic of the gas market in Pakistan is tough. The existing LNG importers Pakistan State Oil (PSO) and PLL are facing a circular debt of over Rs 100 billion in LNG due to a lack of a legal framework to recover the price of LNG from the consumers.

Today, the LNG price in Pakistan has been higher up to Rs 1300 or $8.6 per MMBtu compared to Rs 300 per MMBtu or $2 per MMBtu for domestic consumers. However, the CNG industry is paying price but other consumers like the export industry and fertilizer receive LNG at half price. The government provides a subsidy to domestic, industrial, and fertilizer industries.

Secondly, private parties were setting up two LNG terminals that require the pipeline to transport gas to the gas-starved province of Punjab. Pakistan has been working on building an LNG pipeline with Russia since 2015. However, the Russian firms delayed work due to US sanctions.

In this scenario, the LNG market has many challenges.

There are some other challenges as state-run gas companies Sui Northern Gas Pipeline Limited (SNGPL) and Pakistan LNG Limited (PLL) fear losing the market. Therefore, they have been resisting the entry of private parties into the LNG business. CNG is a cash customer. LNG is an alternate fuel in the transport sector. Though the Petrol rate today is high, there is still an opportunity for LNG business in the transport sector.

In this scenario, Saudi Arabia will face many challenges in establishing a terminal.

LNG demand

The current gas production in Pakistan is 4 billion cubic feet per day (Bcfd) since 2000. There has been no increase in its production. However, a network of the gas pipeline continues increasing, pushing the demand upward.

Pakistan is currently importing 1.2 bcfd. The production of indigenous gas is declining 6 percent annually despite adding gas from new fields. Pakistan authorities hope that the demand for LNG will jump up to 3 years in a couple of years due to rising demand. Therefore, Pakistan has still opportunities for LNG exporters to win business. In this situation, Saudi Arabia will face competition after it sets up LNG terminal in Pakistan.