Need a Loan? Here’s How Do You Get a Loan from Cash App

How do you get a loan from Cash App? Are you in need of an urgent loan and looking for how to get a loan from Cash App?

You might find the solution you’re looking for as Cash App makes money lending simple with its user-friendly UI and practical features.

Cash App can provide you with the financial support you really wish for, In case you simply need to keep up with your bills or you need an extra amount to cover unforeseen costs.

We will let you know through the procedure of getting a loan from Cash App in this article. Let’s get started and uncover how to get the money you need through the cash app.

Read More:

What is Cash App?

Are you tired of waiting in lengthy queues at the bank or finding it difficult to access your money while you’re on the go?

Your one-stop mobile banking solution is the Incontrare Cashier App! With just a few clicks on their smartphone, users of the peer-to-peer (P2P) payment service Cash App can send, receive, and borrow money.

Cash App became popular as one of the top mobile banking apps available today. Cash App incorporates a number of features that make banking simpler and more accessible than ever before. The cash app is the best option for taking a loan for your needs.

How Do You Get a Loan from Cash App {Process for the Cash App Loan}

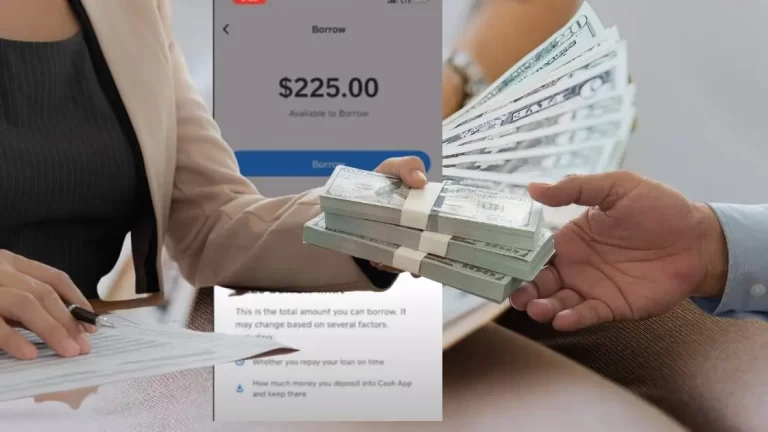

Money App a lending service called Borrow is provided by Cash App, a well-known mobile payment app. It offers a lending service that allows easy accessibility to small loans for users.

In order to apply for a loan, here are few a points to know.

- Users must be eligible and have an active ATM Card.

- Once they are qualified, users can utilize the app’s borrow feature to select the loan amount they want to take out, up to the maximum loan limit.

- Users will receive information about the privacy policy, costs, and interest rates of the loan after requesting the loan application.

- The loan is accepted and the money is transferred into the user’s Cash App balance if they accept the terms and conditions.

- The refund procedure is automatic, and on the due day, the required sum will be taken out of the user’s App Cash balance. You will be charged more if you decide to pay manually.

- Users of Cash App Borrow have the option to borrow again when the loan is repaid.

- To prevent running up credit card debt, consumers should be mindful of the costs and interest rates attached to Cash App loans.

Things to point out before requesting a cash app loan

In order to make an informed selection, it’s crucial to be aware of a few critical points prior to submitting an application for a cash app loan. Before requesting a cash app loan, be aware of the following five things:

Eligibility requirements:

You must fulfill certain requirements in order to be eligible for a Cash App Loan. This includes being at least 18 years old, residing in a state where Cash App Loans are permitted, possessing a Cash Card that is activated, often using Cash App and satisfying credit conditions.

Terms and conditions for loan:

Cash App Loans are offered in quantities between $20 and $200. You will need to go for another option if you need to borrow more than that.

Return Policy:

Four weeks are allotted for loan repayment, and when it’s time, the money will be automatically taken out of your Cash App balance. To avoid late fines and other penalties, it’s crucial to make sure your account has enough money in it.

Rates of fees and interest:

You must carefully examine the terms and conditions before accepting a loan offer because cash app loans have fees and interest rates. Make sure you are aware of the fees related to using this service to borrow money.

Alternative Loan Options:

If you are not qualified for a cash app loan or need to borrow more money than the loan’s maximum, you might want to think about borrowing money through a personal loan, credit card, or another short-term lending option.

To determine which choice best suits your financial requirements, investigate it and contrast it with Cash App Loans.

How to Take Out a Loan on the Cash App?

Currently, Cash App offers only one method of borrowing money: its Cash App Loans service.

Through this service, qualified users can apply within the app for short-term loans with amounts ranging from $20 to $200.

Cash app loans have a four-week repayment period and variable interest rates based on the loan amount and the borrower’s creditworthiness.

You’re in luck if you’re wanting to borrow money with Cash App! An explanation of how to use Cash App to borrow money is provided below:

Learn how to apply for a cash app loan

Within the app, you can submit an application for a cash app loan. Here is a complete guide to getting a loan from the cash app.

- Determine eligibility:

Make sure you meet the requirements for Cash App Loans before applying for a loan. These include having a valid debit card, being at least 18 years old, meeting the credit standards, residing in a state that offers Cash App loans, often using the Cash App, and having an activated Cash Card.

- Access to Cash App Loans:

On your smartphone, launch the Cash App and select the “Cash” tab at the bottom of the screen. After that, click “Cash App Loans” to start the application.

- Select the loan amount:

Enter the loan amount you require. Loan amounts offered by Cash App range from $20 to $200.

- Fill out the application:

You will need to provide some basic personal and financial information after choosing your loan amount. Your name, address, date of birth, Social Security number, employment details, and income are all included.

- Review loan conditions:

Cash App will display the loan terms, including the interest rate and repayment time after you submit your application. Before accepting the loan offer, carefully read the terms and conditions.

Are Cash App loans secure to make?

If you’re considering borrowing money with Cash App Borrow, you might be curious about the security measures in place to secure your financial and personal data. Here are a few satisfactory points cash app users know, about why Cash App Borrow is risk-free.

- Only verified users will have access to the app and their accounts. These features make the cash app one of the best apps.

- The owners of the cash app claim that the user’s data will not be displaced or shared with other third-party organizations. For further verification and satisfaction, users can visit the privacy policy of the cash app.

- Users may get comprehensive information about their loans and repayment alternatives from Cash App, which is upfront about fees, terms, and conditions. Users can manipulate this data to make knowledgeable choices about using the app to get a loan.

Conclusion

Borrowing money through Cash App can be an effortless and easy process. Users can make fair decisions and get loans accountably by using the suggestions and knowledge provided in this article on how to get loans from Cash App.

To raise your credit score over time, keep up solid borrowing practices together with timely payments and reliable loan management. So cash app can be the best choice to fulfill your needs.