NBP Funds: Investors’ Guide to invest in Stocks

Ibn-e-Ameer

NBP Fund Management Limited (NBP Funds) is the leading Asset Management Company in Pakistan that provides low-cost mutual funds.

You can benefit from NBP funds, whether you are financial professionals, individual investors, or representing a corporate entity or any other institution.

The NBP Funds is managing savings of over 18,060 Crores of investors in various investment solutions.

National Bank of Pakistan and Baltoro Growth Fund are the main sponsors of the company.

It has played a key in promoting Pakistan’s investment opportunities as it utilized its financial engineering expertise.

It offers a comprehensive range of investment products and services to meet its investors’ requirements.

Read More: Nafa stock funds: A Tale of Investing in NAFA Stock Fund

The company offers different schemes for investment. NBP stock fund is one of them that offers lucrative return rates to invest.

It has four funds which you can choose to invest in stocks.

Minimum investment

Growth units – Rs.10000

Income units -Rs.100, 000

Load with Life Takaful:

Amount Up to Rs. 5 million: 3%

Amount over and above Rs. 5 million: 1% (Nil if greater than 50 million)-

1: NBP Islamic Savings fund

It offers you opportunities to invest and earn a reasonable rate of return in a Shariah Compliant manner.

You can invest in Shariah Compliant Debt securities, Money Market instruments, and Bank Deposits.

2: NBP Islamic Mahana Amdani Fund (NIMFA)

NBP has this fund to provide monthly income to investors who invest in Shariah Compliant Money Market and Debt avenues.

3: NBP Sarmaya Izafa Fund

It helps generate income if you invest in debt and money market securities.

It also generates capital appreciation if anyone invests in equity and equity-related securities.

Read More: NITL to Launch Two New Funds

The fund size amounts to Rs. Three thousand sixty-three million as of 30th June 2021.

The minimum investment you require is Rs. 1,000/- (Rs. 10,000/- at the time of account opening.

4: NAFA Islamic Pension Fund (NIPF)

The purpose of this fund is to secure your savings and ensures regular income after retirement. However, you can do it all in a Shariah Compliant manner.

It has different sub-funds like NIPF Debt Sub-Fund and NIPF Money Market Sub-Fund.

Equity Sub-Fund

You may invest in equity to obtain long-run capital appreciation and attractive returns with exposure to the stock market’s volatility.

Debt Sub-Fund

You may invest in Fixed Income securities, such as TFC’s that ensure good credit rating and liquidity by choosing this fund.

Money Market Sub-Fund

You may also prefer this fund to invest mainly in short-term Shariah Compliant money market instruments, like Islamic Bank deposits.

This option will provide a regular and stable profit stream.

5: NBP stock fund

Its objective is to provide long-term growth to investors by investing primarily in listed companies in Pakistan.

Read More: Guidelines on Mutual Fund Digital Platform notified

The fund size also amounts to Rs. Twenty thousand six hundred ninety-four million as of 30th June 2021.

NBP mutual funds Profit Rates

NBP mutual funds offer three options for investment if you switch to invest up to one year.

12% return per annum with low risk

15% return per annum with a moderate risk

18% return per annum with a high risk

So, the fund’s profits rates vary according to risk, which may be low, high, and moderate.

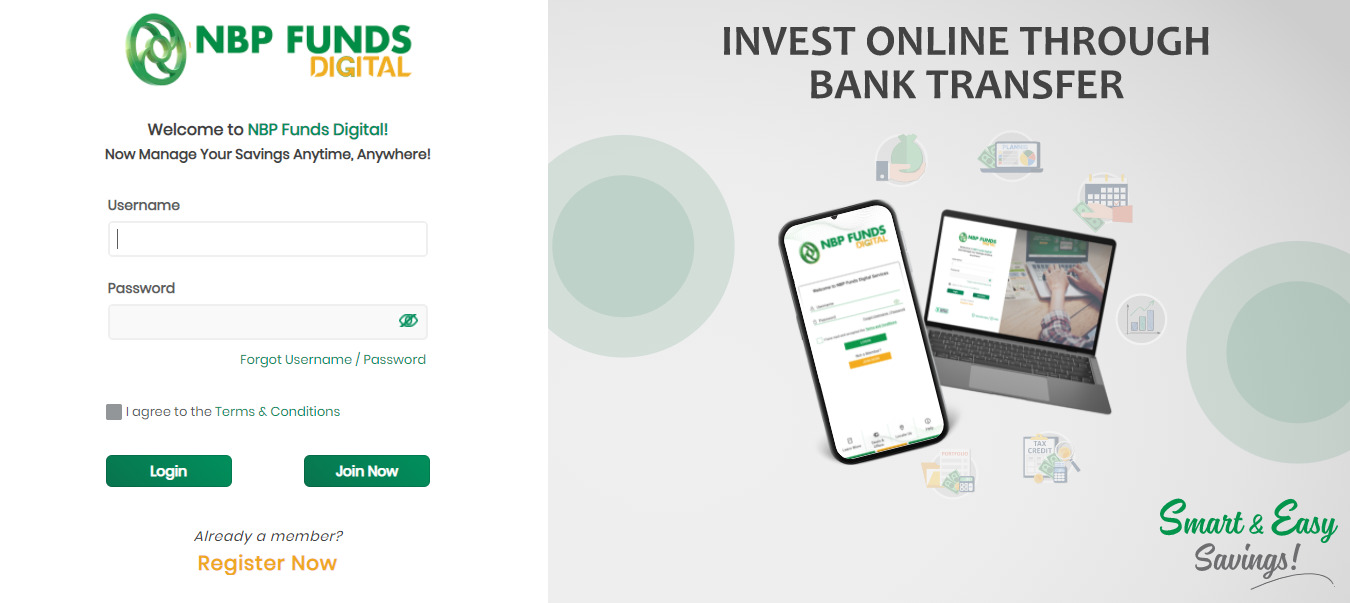

NBP Funds Login

You have to create your account on the website and password to enter into your account.

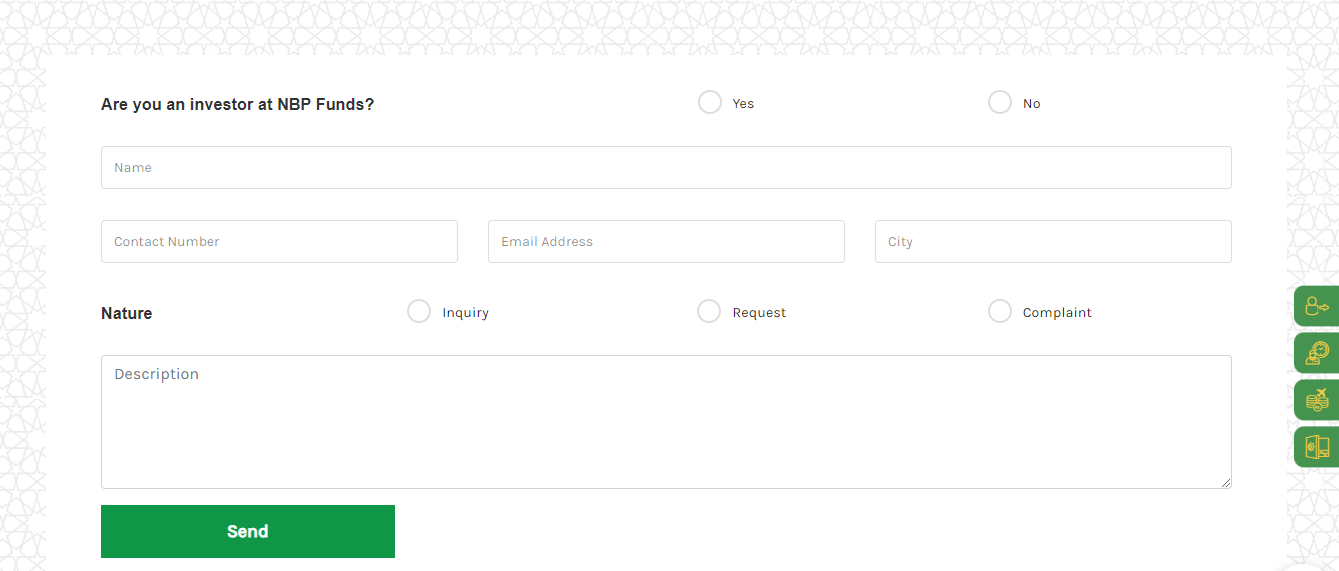

NBP Complaint

The head office of NBP funds is in Karachi. However, NBP has its portal to know about the NBP Nafa scheme, monthly profit, contact number, branches, and funds manager.

Meanwhile, you can also have an option of query and complaint on its website, where you can complain by entering your name and email account.