Pakistan to sell $500m green Euro bond

Aftab Ahmed

Pakistan is likely to sell USD500 million 10 years green euro bond in the international market on Friday (tomorrow) to raise money for Water and Power Development Authority (Wapda) projects.

Pakistan’s euro bond rate is likely to be close to 8%.

Moreover, final guidance is at 7.5% – 7.625%, and demand is already close to USD 3.0 billion. The Green Bond issue will be 6 times oversubscribed. This is a big success for Pakistan.

The government of Pakistan has already allowed Water and Power Development Authority (Wapda) to raise money. It had selected JP Morgan to lead a consortium of three global leading banks that will assist in floating US$500 million Eurobonds in the global market for two mega-dams in Pakistan.

Meanwhile, this consortium includes JP Morgan as global coordinator to market issuance of Eurobond. This is the biggest international bank with an unmatched experience of issuing bonds.

Other international banks include Standard Chartered and Deutsche Bank. Subsequently, this consortium of international banks would help market issuance of Eurobonds and minimize the global market risk.

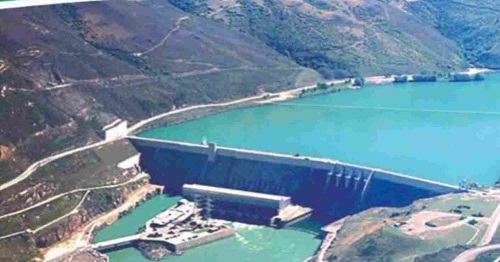

WAPDA is currently undertaking a challenging and mammoth task of developing Diamer Basha Dam and Mohmand hydropower Project projects in Pakistan which needs money to raise through issuing Euro bonds at an affordable rate.

Construction activities are underway. ECNEC had approved PC-I for Mohmand Dam and Diamer Basha dam in November 2018 and April 2018 with foreign components (FFCC) of USS 1,462.5 million (Exchange Rate USS = Rs. 105.3) and Exchange Rate US – Rs. 112.06), respectively. Wapda is to raise around US $2.025 million through commercial borrowing as per the financial model.

Implementation of these projects is in full swing. The contractors are generating invoices, including foreign components, against the ongoing works. To arrange foreign financing, WAPDA is embarking upon a multi-pronged strategy that includes Multilateral Donor Agencies friendly countries, Syndicate Loans, and Eurobond in Pakistan.

Additionally, WAPDA approached AlIB and Middle-Eastern Donors through Economic Affairs Division (EAD) to provide concessional financing on competitive terms. However, it is still waiting for outcome.

Regarding Syndicate Loans, the Water Resources ministry highlighted that euro bonds are available for Pakistan with tenuor of 1-2 years at best. Such short tenor loans do not synchronize implementation periods of the projects, which is 60 months for DBDP and 86 months for Eurobond is thus a natural instrument of choice due to its tenor of 7-10 years. It would diversify the liquidity pool of WAPDA. Meanwhile, it will access in a phased manner as a regular feature as per the drawdown projects.

https://newztodays.com/wapda-to-raise-security-force-for-protection-of-diamer-basha-and-mohammad-dam-projects/

Furthermore, issuance of Eurobond for Pakistan involves several steps from conducting shows obtaining international credit rating, hiring a Global Coordinator, and appointing the transaction parties (legal counsel. WAPDA conducted shows for the purpose in July-August 2018 and April 2019 in Dubai and the United Kingdom.

During this process, Wapda approached a total of 57 institutions including international institutional investors, hedge funds and insurance companies under management ranging from a few billion to trillions of dollars.

Moreover, the companies included PIMCO, Blue Ray. Goldman Sachs, Aventicum, Man Group, Ashmore, Franklin Templeton, and Eaton Vance, etc. Subsequently. WAPDA obtained a Letter of Comfort from the Finance Division for the rating process as investors heavily rely on assessing the rating gauging the issuer’s creditworthiness.

Meanwhile, WAPDA takes pride in the fact that all international credit rating agencies, including Fitch S&P and Moody’s, unanimously placed WAPDA at Rating B’.

Currently, work is underway for completing issuance prospectus and instrument credit rating, WAPDA targets to launch US$500 million Eurobond in January 2021.