SECP revamps REIT Regulations to promote real estate

Islamabad: To promote investment in the real estate sector through Real Estate Investment Trusts (REITs), the SECP has introduced a new Public-Private Partnership (P3) model under REITs, besides completely revamping the regulatory framework for REITs.

The amendments have shifted the regulatory structure from approval-based to disclosure-based issuance, reducing entry barriers for new REITs. It will make REITs competitive with the unorganized sector-led real estate projects, cutting down regulatory approvals and attracting domestic and foreign investment into the formal real estate sector of the country.

After extensive consultations with all stakeholders, the regulations have been finalized to bring in amendments in conformity with domestic market conditions and sync with globally recognized norms.

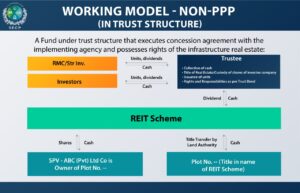

The revised framework has clarified segregation between conventional and infrastructure categories, i.e. Non-PPP REITs (for conventional projects) and PPP REITs (for P3 infrastructure projects). REIT Management Companies (RMCs) may pursue developmental, rental or hybrid options under both these classifications.

Moreover, several regulatory approvals and document submission requirements have been rationalized. A REIT Scheme can invest in real estate, either directly or through the acquisition of the company’s shareholding (the SPV model) that owns the real estate.

In the SPV model, the earlier condition of transferring the title of real estate in the REIT scheme’s name is eliminated. To speed up and simplify the process, real estate does not require the SECP, as evaluating the quality of real estate is placed on the RMC and the trustee. Limits on leverage and performance fees have also been uncapped, and permission has been granted to allow the use of customer advances allowed for project-related expenses.

Also, the holding’s in the REIT Scheme by strategic investors and RMC have been rationalized by linking the same to initial fund size. Further, the existing Non-PPP REIT schemes are allowed to acquire additional real estate in existing REIT schemes with the unitholders’ approval.

The PPP REITs are allowed to partner with the government for PPP infrastructure projects. It is ensured that the REIT regulations would not create any interference with the terms of the concession agreement, the main document governing PPP infrastructure projects. The P3 model of infrastructure REITs provides a viable solution to streamline investments for the country’s ever-growing infrastructure needs.