Windfall Tax Reshapes Pakistan’s Banking Sector

Staff Report

A windfall tax is reshaping Pakistan’s banking sector as it brings financial implications for key banks in Pakistan.

In its latest report, released on November 22, 2023, Akseer Research Pvt. Ltd. provides an insightful analysis of the financial repercussions of the recently implemented windfall tax on the foreign exchange incomes of major Pakistani banks.

The report, titled “Impact of Windfall Tax on Foreign Exchange Income of Banks under Section 99D,” released by Akseer Research shows how windfall tax has had an effect on Pakistani banks. Pakistan Banks’ Earnings Surged by 95% in 3Q2023

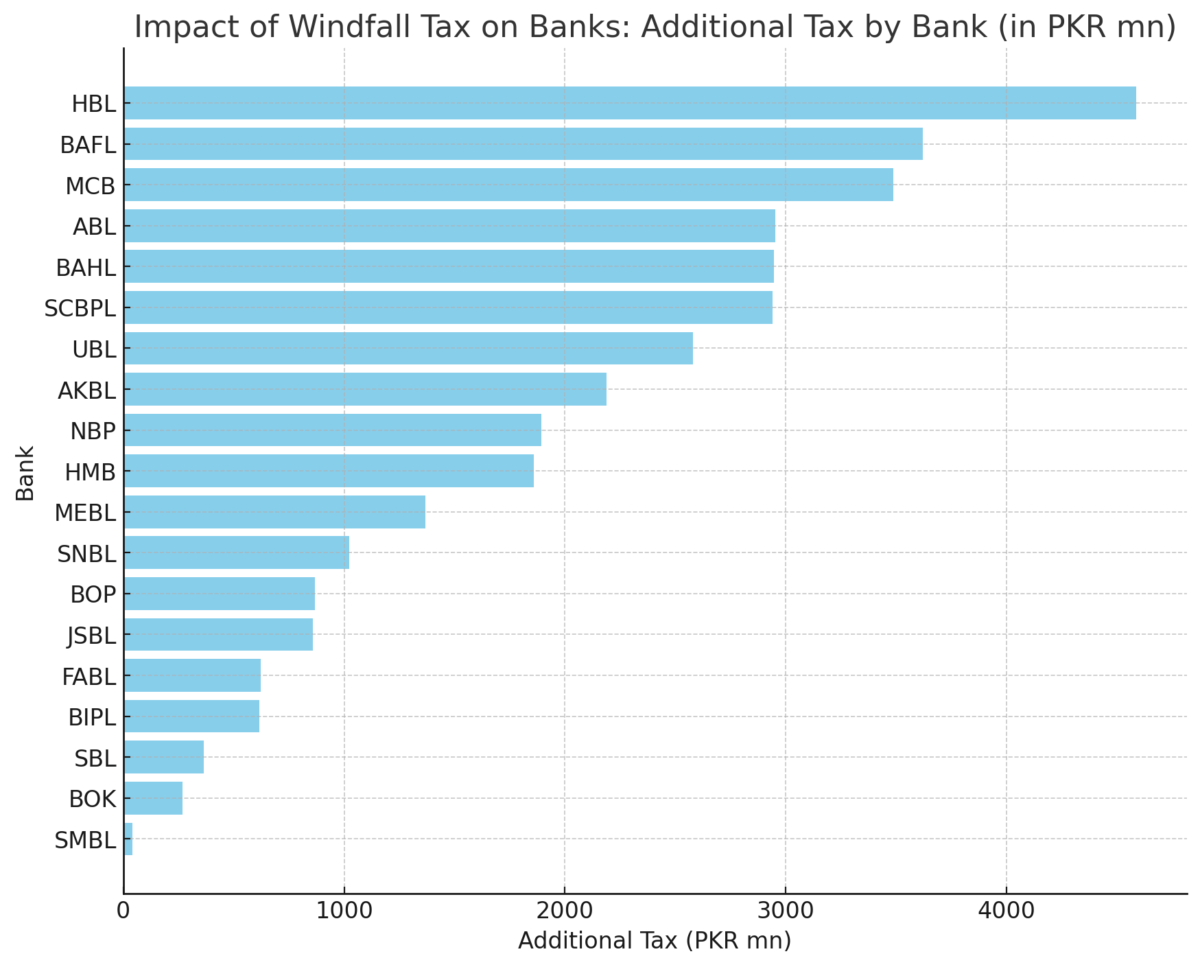

This tax is going to have a substantial impact on all banks For instance, Standard Chartered Bank Pakistan Ltd. (SCBPL) faces an additional tax of PKR 2,942 million, a considerable 40% of its total foreign exchange income of PKR 7,354 million.

Habib Bank Ltd. (HBL), with a 15% additional tax, must pay PKR 4,589 million, and the National Bank Of Pakistan (NBP) is subject to a 7% tax, amounting to PKR 1,895 million.

The impact is not uniform across the board. Banks like Bank Alfalah Ltd. (BAFL), MCB Bank Ltd. (MCB), and United Bank Ltd. (UBL) also encounter significant tax liabilities under the new legislation.

BAFL, for example, is expected to contribute an additional PKR 3,622 million, equating to 10% of its total foreign exchange income.

While Samba Bank Ltd. and The Bank of Khyber experience a steep rise in tax liabilities, Summit Bank Ltd. shows no additional tax due to negative income.