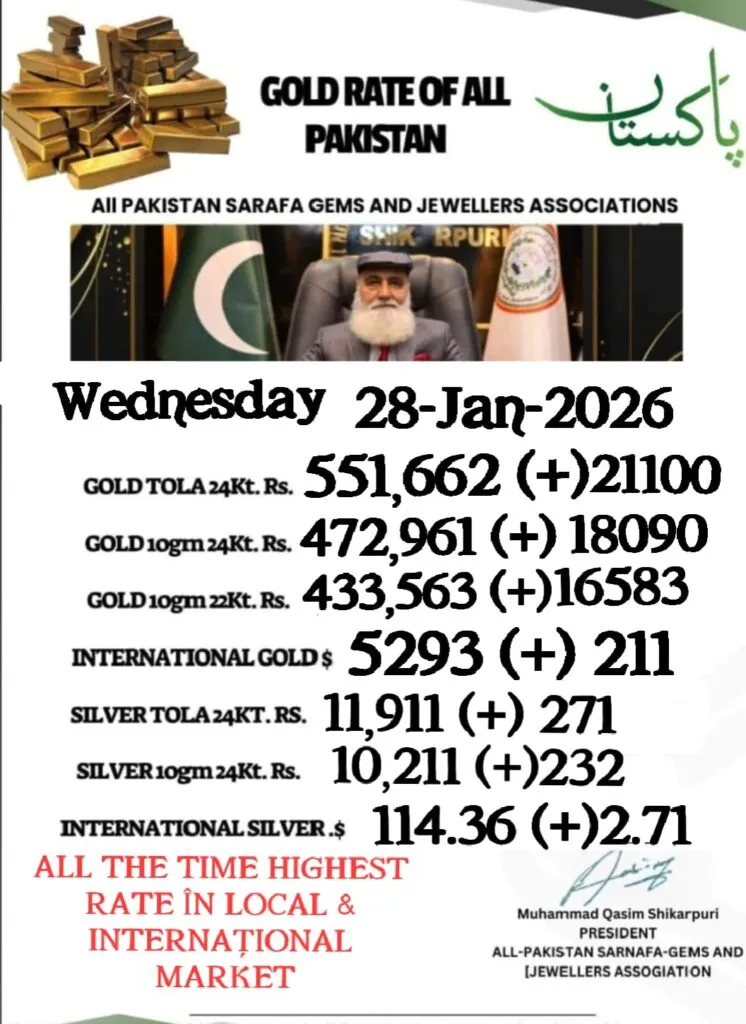

Gold prices surged past $5,200 per ounce on Wednesday as the US dollar dropped to near a four-year low amid ongoing geopolitical concerns and ahead of the Federal Reserve’s policy decision.

Spot gold rose 1.4 per cent to $5,262.66 per ounce, reaching an intraday record of $5,266.37, marking a gain of more than 20 percent since the start of the year.

US gold futures for February delivery climbed 3.4 per cent to $5,255.30 per ounce, reflecting strong investor demand amid dollar weakness and global uncertainty.

Analysts said gold’s rise is closely linked to the dollar, which has struggled following comments by President Donald Trump suggesting a preference for a weaker currency.

The US dollar faced a “crisis of confidence,” trading near four-year lows, after Trump described the dollar’s value as “great” despite its recent decline, adding market volatility.

Read More: Reko Diq to Set Mineral Standards, Boost Pak-Australia Ties

US consumer confidence also fell to its lowest level in over 11 years in January, driven by high prices and concerns over a slowing labour market.

Trump said he will soon announce a nominee for the Federal Reserve chair, predicting interest rates could decline under the new leadership, increasing market uncertainty.

Analysts noted that markets are cautious ahead of Fed Chair Jerome Powell’s remarks, with resistance for gold expected near $5,240 per ounce in the near term.

Deutsche Bank projected that gold could reach $6,000 per ounce in 2026, citing sustained investment demand and growing allocations to non-dollar and tangible assets.

Other precious metals also recorded gains, with spot silver up 2 percent at $115.40, platinum rising 1.7 percent to $2,685.16, and palladium increasing 0.7 percent to $1,946.75.