How can I see my Venmo card number online| Yes, Here is How!

By Newztodays Team

How can I see my Venmo Card Number Online? If you are a Venmo user, you might be looking to learn about it.

It’s as easy as a few taps on your smartphone! By following these simple steps in the Venmo app, you can quickly access your card number, expiration date, and CVV code.

But don’t forget to activate your card first!

Venmo provides a debit card that allows users to spend money in their Venmo account at any Mastercard-accepting business.

The Venmo debit card can be used for bill payment as well as cash withdrawals from ATMs for online or in-person shopping.

You need to have a functioning Venmo account and have established your identity before you can apply for a debit card from Venmo.

After being accepted, you can use the Venmo app to order a real card, which usually comes in 7–10 business days.

As an alternative, you can activate your card right now by adding it to a digital wallet like Apple Pay or Google Pay.

You are allowed to use the Venmo debit card for purchases up to $3,000 in a rolling seven-day period.

Nevertheless, based on your account activity or other variables, this limit might be lower.

It’s vital to carefully read the terms and conditions because there can also be charges for using the card, such as foreign transactions or ATM fees.

There are different steps involved in the entire process. First, you need to sign up for an account with Venmo you can do this on the app and computer as well.

How to Create Venmo Account?

Here are a few simple steps you can follow to create a Venmo account.

- Download the Venmo app on your mobile device

- Launch Venmo App

- Select a method of signing up for an account

- Create a password ranging between 8-20 characters with symbols like (!@#$%))

- Enter Phone numbers and email addresses and then verify

- Link your bank account and verify

- That is all you need to do to sign up for your account

How to Apply for a Venmo Debit Card?

The process is also very simple to apply for a Venmo debit card.

- Open Venmo App

- Click on the profile icon at the top left or right bottom corner

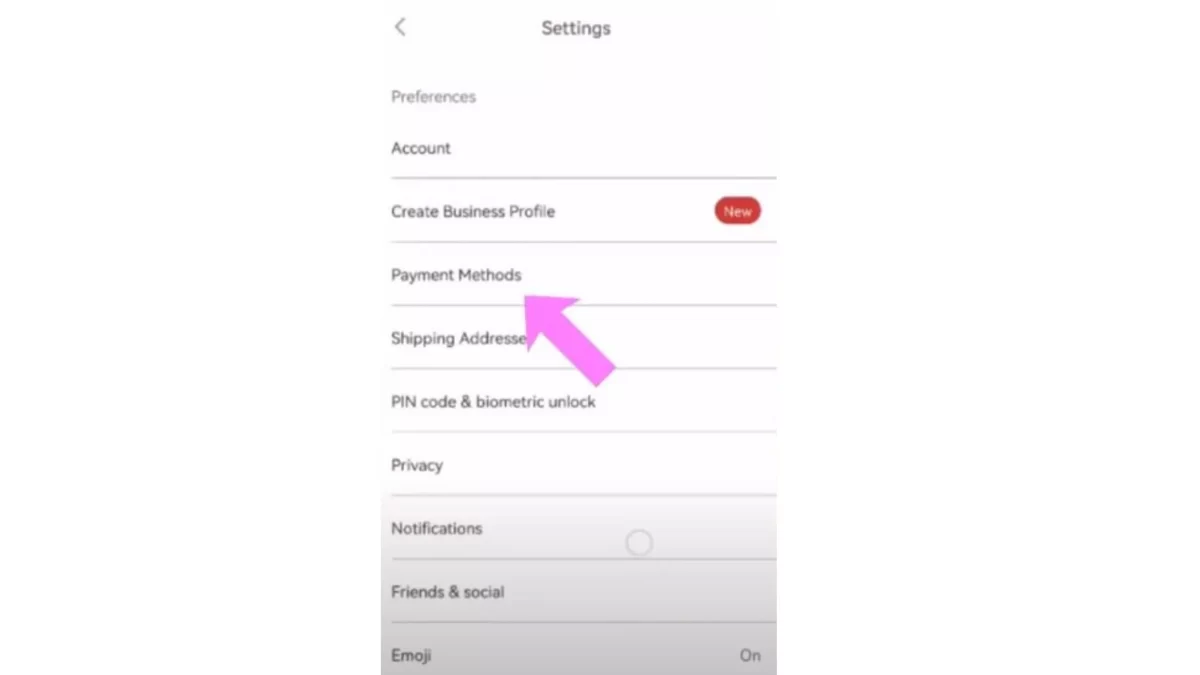

- In the app’s menu, press settings

- Select the “Venmo Card” option and click on it to apply for a debit card

- Enter your personal information like phone number and email address to verify your identity

- Click to confirm the shipping address where you want to receive a card

- Take a careful review of the application and click on “Submit”

How to Track Venmo Card Delivery

After the Venmo app system has approved your application, there will be the next process of delivering the card.

You can even track your card.

- Open the Card Tracking section in the Venmo App

- Click on Settings to find out the “Venmo card” option

- Navigate to “Check Delivery Status”. It will information you real-time information regarding the status of your card’s delivery.

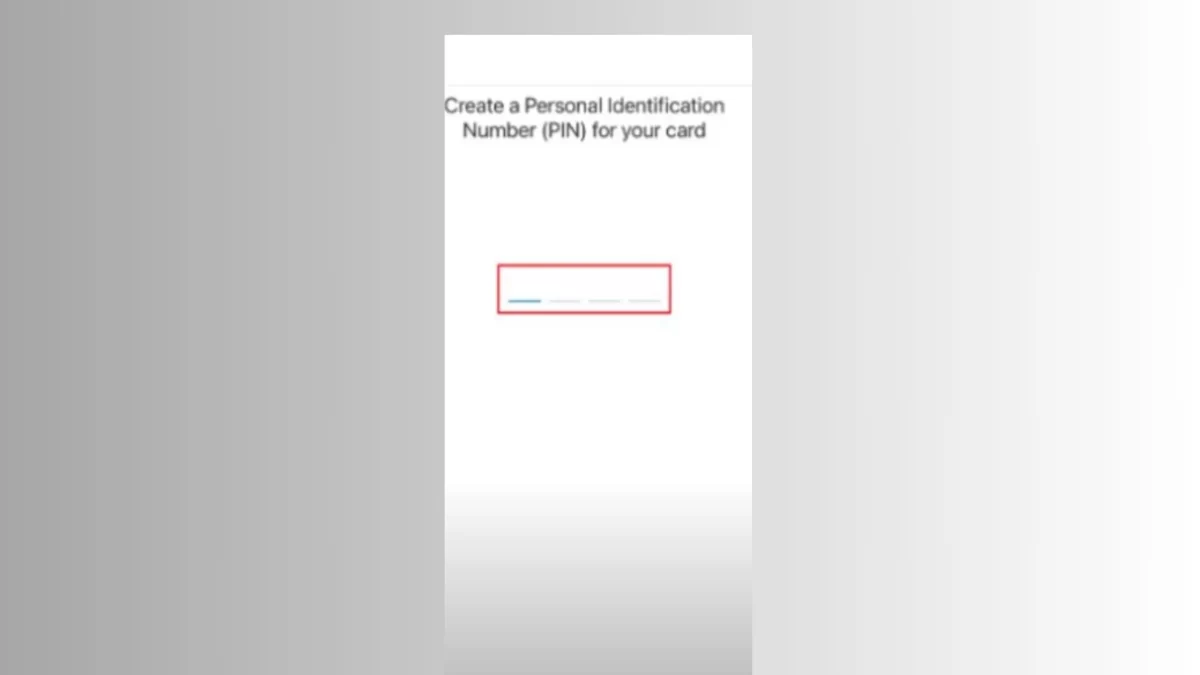

How to Activate Venmo Debit Card?

In the Menu option of Venmo’s App, press the settings

- Click on the “Venmo Card” option

- Click on “Activation”

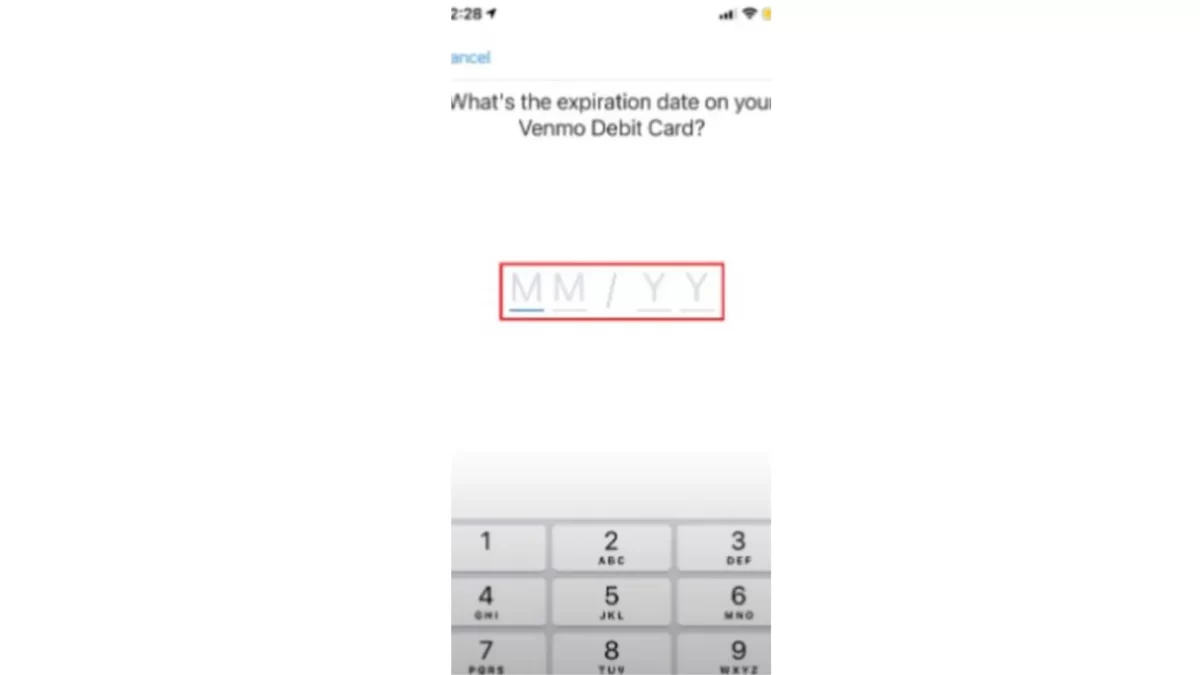

- Enter the expiry date on your Venmo debit card.

- Create a personal identification Number (PIN) for your card

After the card is activated, you will receive a confirmation message of activating the card within the app.

Read More:

- Can I add Cash to My Venmo Card at Walgreens?

- How to Deposit a Check on Venmo| Here is a Solution

- How to Order New Venmo Card| A Step-by-Step Guide

- Does Venmo Accept Chime| Yes, Transfer Money with Ease

- Does Venmo work with Cash App| A complete Guide!

Does Venmo offer a digital debit card?

The Venmo Debit Card is actually a Venmo virtual debit card that works with Venmo. Mastercard debit cards can be used online and in stores.

When linked to the Venmo Debit Card, your Venmo balance can be spent at checkout.

The Venmo mobile app lets you track spending, balances, and more. Be cautious to read the terms and restrictions before using the Venmo Debit Card, as there may be costs.

How to See Venmo Virtual Debit Card Number?

Does Venmo have a virtual debit card? Yes, Venmo has a virtual debit card number and you can easily access it.

If are a Venmo user and attempting to access the virtual card number, it is not too difficult a task.

You can find out by visiting the Venmo credit card section in the Venmo app.

You will be required to enter the last four digits of your social security number to verify identity

You can see the virtual card number, expiry date, and CVV

How to use Venmo Virtual Card?

Synchrony Bank issues the Venmo Credit Card. Along with the physical card, you can also get a virtual credit card number.

You can use a physical Venmo card at the store to make purchases within and online. You can add it to the payment method of the Venmo app to make payments.

However, You can also use your Venmo virtual card number to do shopping.

How to Add a Virtual Card to a Venmo Account

You can also connect your virtual card with your Venmo account easily by following a few steps.

- Open your account Dashboard

- Press the “activate virtual card button”

- If you are using mobile, open the account dashboard

- Click on “Cards”

- Press “Virtual Card”

Is it possible to use Venmo without a Venmo debit card?

If you don’t have a Venmo debit card, you can still use Venmo. Venmo lets users transfer and receive money from friends and family.

Venmo lets you link your bank account or credit card to make purchases or send money to others.

Without a debit card, Venmo lets you send and receive money. If you use a Venmo debit card, you can make purchases and ATM withdrawals.

Constraints and downsides:

Regarding constraints and downsides, Venmo does charge some fees for using its debit card and has several limitations:

- The daily withdrawal and expenditure caps are $1,000 and $3,000, respectively.

- You will be charged $2.50 if you use an ATM that is not part of the Money-Pass network to withdraw money.

- A foreign transaction fee of 3% of the transaction amount will be applied if you use your Venmo debit card to purchase a foreign currency.

- Inactivity Fee: You will have to charge $5 per month if your account is inactive for 90 days.

- Expedited Transfer Fee: You will be charged 1% (minimum $5) to make instant transfers to bank accounts.

- Card Replacement Fee: You will have to pay $15 for lost or stolen cards

- The Venmo debit card may also come with additional fees, such as a fee for replacing a card that has been lost or stolen.

- The Venmo debit card can be a practical way to access your Venmo balance and make purchases, but it is crucial to understand that you cannot establish credit by using it as it is not a credit card.

Benefits

Venmo debit cards have many benefits, as your Venmo balance is easily accessible with a debit card.

Venmo debit cards don’t require credit checks, making them an excellent option for folks with poor credit or who don’t use credit.

Venmo debit cardholders can earn cashback benefits at specified businesses, which can save money over time.

Improved security: Venmo debit cards can be reported and disabled, and transactions can be monitored in real-time.

Integration with Venmo app: Users may quickly update their card settings, check transactions, and track spending with the Venmo debit card.

The difference between my physical and my virtual Venmo debit card number?

Your Venmo Credit Card can be used for in-app payments, online purchases using your virtual card number, in-store and online use of your physical card, and more.

Online and offline, you can use your physical card number. Cash advances and contactless payments are possible with its chip.

On the Venmo app’s Credit Card section, you may see your virtual card number. You must validate the last four digits of your Social Security number to display the virtual card number, expiration date, and CVV.

How Can I see my Venmo Card Number Online?

How can I see my Venmo debit card number online? I am sure you are looking for it. Through the Venmo app, you can view the number on your Venmo debit card by doing the following:

- Open the Venmo app on your smartphone.

- At the top left corner of the screen, tap the icon with three horizontal lines.

- Choose “Venmo Card” from the options.

- Select “Show Card Info” to find out the card number, expiration date, and CVV code.

- Activate your Venmo debit card before accessing its data in the app. Your card’s instructions or Venmo customer service can activate it.

How do I get a Venmo digital card?

These actions should be taken to obtain a digital Venmo debit card:

- Open the Venmo app on your smartphone.

- To enter the menu, tap on the three horizontal lines in the top left corner of the screen.

- “Venmo Card” will be selected in the menu.

- To apply for a Venmo debit card, follow the on-screen instructions.

- Once accepted, you can use the digital card to make online purchases or add it to your mobile wallet.

How can I use Venmo to make a withdrawal without a card?

You can still transfer your Venmo amount to your bank account even if you don’t have a Venmo card. Steps to learn about it.

- Launch the Venmo app on your smartphone.

- At the top-left area of the app, tap the “☰” icon.

- Choose “Transfer to Bank” from the menu.

- Your desired transfer amount should be entered.

- Choose the bank account that you want to receive the funds from.

- To review the transfer specifics, tap “Next”.

- To finish the procedure, tap “Transfer”.

- A few business days may pass before the transfer appears in your bank account, so keep that in mind. Additionally, conventional bank transactions are free, but Venmo charges 1% for quick transfers.

Can we use Venmo internationally?

No, Venmo only accepts transactions in U.S. dollars and is only currently accessible for usage domestically. Venmo does not support international transactions or receive payments in different currencies.

Security Risks of Debit Cards

There are some security risks associated with using any debit card.

Direct Access To Bank Account

If you are going to use debit cards, it may be risky as they are directly connected to your bank funds.

There may be phishing and card skimming efforts on part of hackers to steal your data and card information.

Therefore, you should avoid using debit cards at such merchants or ATMs that are not trusted.

If you have lost your card, you should take immediate action to block it. Venmo provides facility of locking and transaction monitors. So, be vigilant while using card.

Read here privacy features.

Explore Debit Cards and Payment Options Beyond Venmo

Depending on one service may not be a good option. You should explore other alternate options to get better service at a competitive rate.

Let’s find out the debit cards and payment methods beyond Venmo.

There are three issues you should consider.

Are you looking for rewards like cash back, travel points and, other perks.

Are you interested in monthly fees, ATM charges and, freight transaction protection deal breakers?

Do you want to find outbudgeting tools, purchase protection, or international accessibility?

Debit Card Diversification:

- Cash Back Cards: Earn rewards on everyday purchases with cards like Discover it® Cash Back (5% rotating categories) or Citi® Double Cash Back (2% on everything).

- Travel Rewards Cards: Frequent flyers might love Chase Sapphire Preferred® Card (points for travel and dining) or Capital One Venture X Rewards Credit Card (travel credits and airport lounge access).

- Student Cards: Build credit responsibly with cards like Discover Student Chrome℠ Card (cashback after good grades) or Capital One Quicksilver Student Cash Rewards Credit Card (simple rewards).

Conclusion

Therefore, the Venmo debit card can be a quick and safe way to access your Venmo balance and make purchases, in addition to delivering some additional perks such as cashback rewards and easy integration with the Venmo app.

In addition, the Venmo debit card also offers some other benefits. You must activate your Venmo debit card before viewing your card details in the app.

Activate your card by following the instructions or contacting Venmo customer care.

FAQs

Q: Can I pay Venmo users using my Venmo Credit Card?

A: Venmo adds your credit card automatically. You can use Venmo to pay friends and authorized businesses with your card.

Q: How long will my Venmo Debit Card arrive?

A: Venmo Debit Cards arrive within 10 working days of approval. Currently, only home addresses can receive the card.

Q: Does applying for the Venmo Debit Card cost?

A: No! Venmo Debit Cards are free.