How to get Car Financing in Pakistan in 2024: A Step by Step Guide

S Sultan

How to get car financing in Pakistan? This is the subject of our discussion to tell you how to finance a car. What are the procedures and requirements to secure auto financing from banks?

There are different banks like HBL, UBL, and Bank Islami that you can approach to avail of car financing in Pakistan.

What does “financing a car” mean?

Auto car financing is a broad issue that covers various economic methods for allowing someone to purchase a car without paying the total price upfront, but instead spending the balance over time in equal monthly installments, plus interest on the total amount required.

This amount is utilized in both the private and business sectors, and it permits the car’s original owner to be recognized.

Read More: Auto Loan for Car: Vehicle Makers Make a Fortune

Car Prices in Pakistan-A Complete Guide

There are numerous car finance methods available, but they may be divided into simple car loans, hire purchases, and car leasing.

Read More: Roshan Apni Car Scheme 2024

1.) Car Loan Financing

Auto car financing or car loans in Pakistan is the most basic form of financing. It acts as a type of loan, allowing you to borrow a specific amount of money from systems such as banks or credit unions and then repay that amount over time.

The amount you borrow, referred to as “the principle,” is lent to you at a cost, referred to as “interest,” which is added to your “monthly installment” payments.

Monthly payments are the same amount each month and borrowed by the determined amount and the interest rate, which is a percentage of the principal.

2.) Hire Purchases

Hire purchase, often known as “closed-end leasing,” is a legal agreement in which the lender purchases the car for you, and then the borrower repays the money over time by renting the products from the lender until the debt is paid off.

The borrower receives ownership of the car once the whole amount of money, plus interest, has been repaid through monthly installments. Because it is essentially a form of leasing rather than borrowing, banks are not engaged.

3.) Car leasing

Car leasing is another option for getting a vehicle without having to pay the total price upfront.

Auto dealerships give it frequently and allow the consumer to use the car for a specified period for which he will pay monthly, basically renting the vehicle.

The main distinction between leasing and “hire purchasing” is that after the lease period ends, usually after two, three, or four years, the consumer returns the vehicle to the dealership rather than assuming ownership.

Meezan Bank car financing

Car Ijarah is the first interest-free product of Meezan Bank in the United States of America. The product is based on the Islamic financing regime of Ijara or leasing obligations, and it is the best option for those who want to get interest-free financing for their cars.

Eligibility Criteria for Meezan Bank Car Loan

- An employee must have at least three months of employment after two years of continuous work.

- Self-employed individuals must demonstrate two years of continuous work with a partner or spouse.

- The income must be higher than one month’s rent.

- Applicants must have a clear e-CIB record without overdue or default data.

A worker must have at slightest three months of employment after two years of constant work. The entrepreneur must have two years of constant work with a partner or partner, and the income must be more than a month’s rent. In both cases, the individual must have a clear e-CIB and verify that the data is not overdue or in default.

More Read: Taxes cut on cars: Prices reduced by Rs 229,458

Discover Meezan Car Financing (Ijarah) – Your Key to Easy Car Ownership!

- Lowest upfront fees in the market

- Pay rent only after car delivery

- The fast approval process with free tracker installation

- Free medical treatment and Rs 400,000 deposit match in case of death

- Meezan covers vehicle tax, not you

Experience hassle-free car ownership with Meezan – Apply now!”

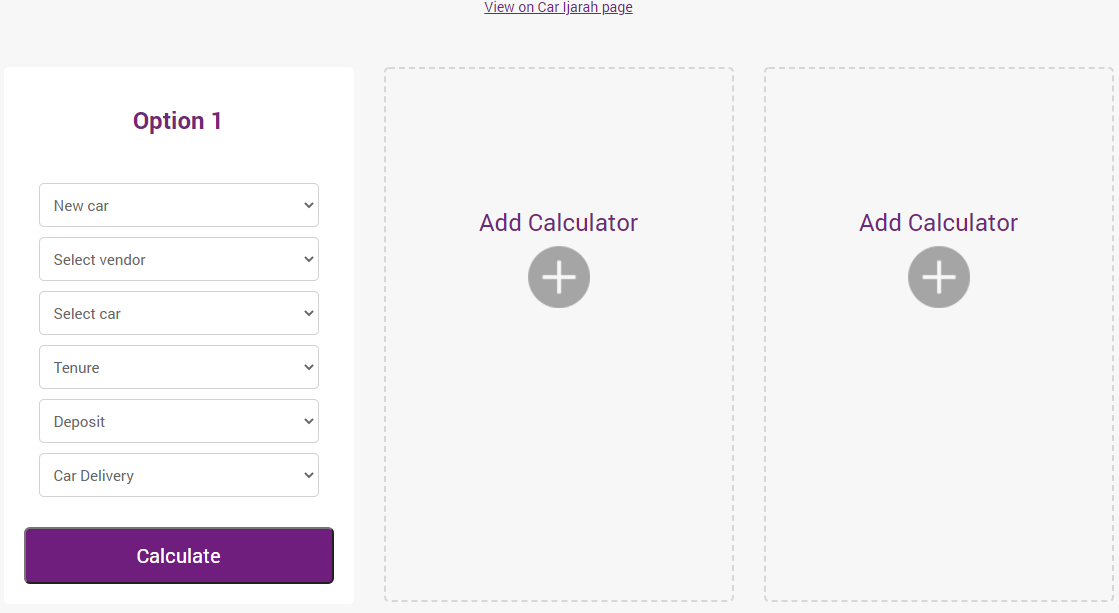

Enjoy the Convenience of Meezan Bank Car Loan:

- Use the Car Ijarah Calculator for easy car financing.

- Compare various cars and payment plans effortlessly.

- Simply input details like car name (new or old), vendor, loan tenure, deposit, and car delivery.

Make car buying stress-free with Meezan Bank – Try our calculator now!”

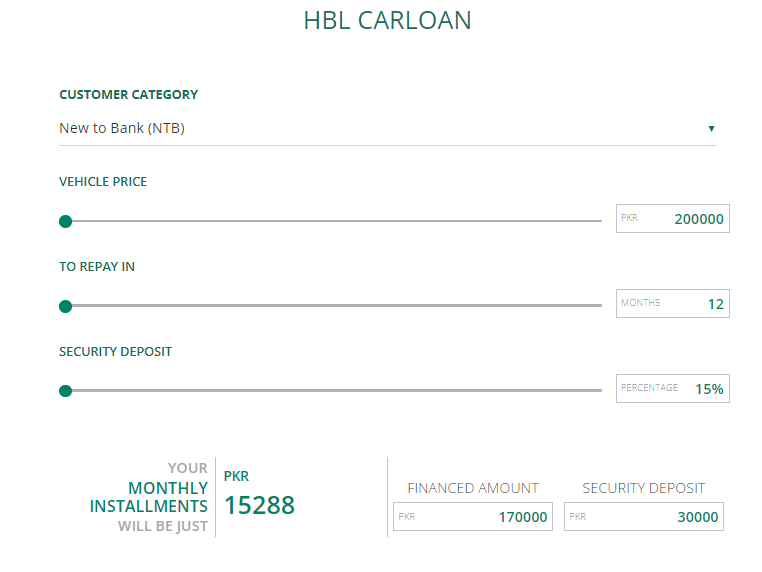

“Explore Hassle-free Car Financing with Habib Bank Limited (HBL):

- Benefit from the lowest interest rates with HBL auto car financing.

- Own your dream car effortlessly with HBL Auto car financing.

- Enjoy flexible repayment options of up to 7 years, tailored to your budget.

Calculate Your Car Loan Easily with the HBL Car Loan Calculator:

- Determine monthly car loan payments, down payments, and loan terms effortlessly.

- Simplify your car financing journey with HBL – Try our calculator today!”

Eligibility Criteria

- Salaried Employees

- Citizenship: Pakistan

- Age: 22-60 years old

- Minimum Monthly Income: Rs 20,000

- For independent work with business people and professionals

- Citizenship: Pakistan

- Age: 22-70 years old

- Minimum Monthly Income: Rs 25,000

Benefits of HBL Car loan

Choose any car, New or used local and imported vehicles. Refund within seven years (5 years for used cars and financing).

- Get up to 85% of your funds for your favorite car.

- Take care of insurance anytime for peace of mind (regardless of whether the tracker is available).

- Take advantage of our round-the-clock assistance available through HBL Phone Banking.

- HBL Phone-Banking, you can also track the repayment/loan status, invoices, and other additional services.

UBL Car Financing

The bank provides a competitive auto loan package that offers the best car finance solutions for its customers ready to make their dream cars.

UBL car financing has several exciting features, including the availability of loans from flexible rates, terms that consumers can sell in more than seven years, 80% of the purchase by the consumer.

Read More: Car for sales in Pakistan down by 17%

Eligibility Criteria for UBL Car Loan

“Unlock the Best Features of UBL Car Loan:

- Finance new, used, and imported cars hassle-free.

- Enjoy minimal deposit requirements and funding up to 5.00 million rupees.

- Choose financing options ranging from 1 to 5 years in Pak rupees.

- Opt for renowned insurance companies with competitive prices and fast processing.

- Experience swift approval with minimal documentation.

Get on the road to your dream car with UBL Car Loan today!”

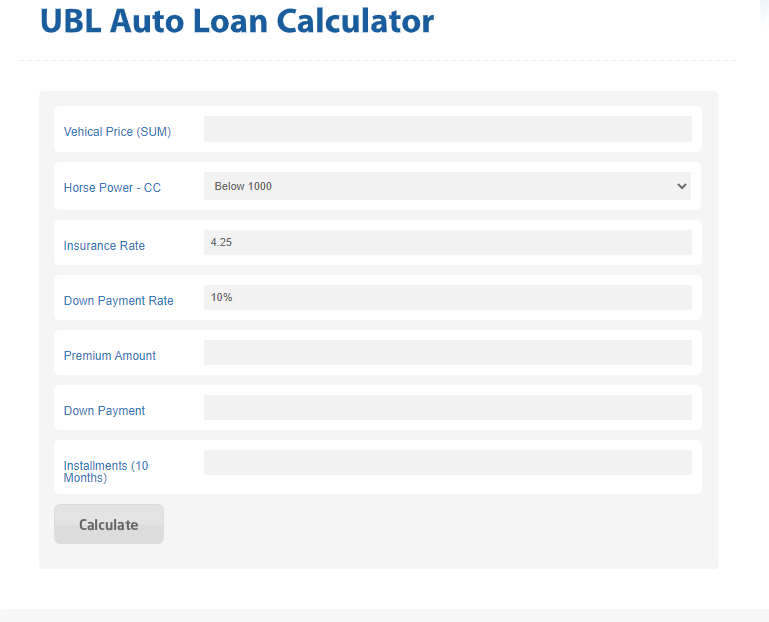

UBL Car Loan Calculator

You can also utilize the UBL car loan calculator if you are eager to purchase a car and require financing from the bank.

You will need to input the vehicle name, engine horsepower, premium amount, and down payment to buy the car in installments.

By using this calculator, you can determine the amount of installment you will need to pay to the bank. Check out the UBL auto loan calculator.

Bank Islami Car Finance Eligibility Criteria:

To qualify for Bank Islami’s Auto Finance scheme, you need to be a Pakistani national with a minimum income of PKR 40,000/- per month. Applicants must be at least 21 years old at the time of application and no more than 60 years old at the time of majority. For self-employed individuals, the minimum age at the time of application is 21, and the maximum age at the time of capability is 65.

Benefits of Bank Islami Car Financing:

- Obtain a brand-new car through Bank Islami’s auto finance for terms ranging from 1 to 7 years.

- Enjoy financing options ranging from 15% to 90% of the vehicle’s consumer price.

- Investment cost should fall between a minimum of Rs. 250,000/- and a maximum of Rs. 10,000,000/-.

- Each application incurs a processing fee of Rs 1,200/-.

- All vehicles financed through Bank Islami require the installation of a tracker, which is facilitated by the bank.

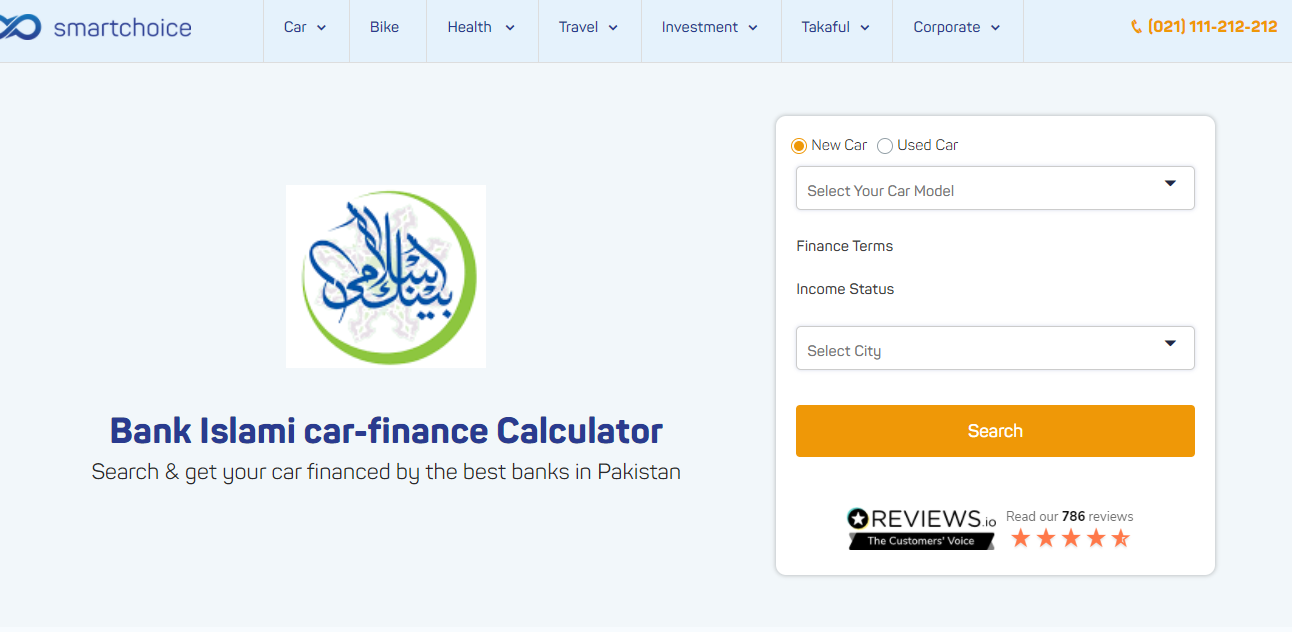

Bank Islami Car Financing Calculator

The Bank Islami car loan calculator simplifies the process of determining eligibility criteria and payment plans for auto financing. It provides a clear breakdown of your payment schedule for acquiring your desired car.

Simply input the car’s name into the calculator, which caters to both old and new vehicles. Specify the car model and your city. Additionally, you can easily understand the financing terms offered by entering your income status.

Use the Bank Islami Car Financing Calculator now to plan your car purchase with ease!

Car Financing in Pakistan

Car financing in Pakistan creates products to assist people in purchasing vehicles with Auto car Financing. Do people want to know how to get car financing in Pakistan?

Various banks provide financing for new and used cars. HBL Car Finance, Dubai Islamic Bank Car Financing, UBL, and Faysal Bank Car Financing are just a few examples of popular car financing options in Pakistan.

How does financing a car work?

Process of car financing

- Although the Car Finance processing differs from one bank to the next, the approach is generally the same. The method of documentation and eligibility criteria of the new car and the used car have been the same.

- Usually, a bank would ask an applicant to meet specific eligibility requirements, provide documentation, and provide financial security for the loan.

- To be eligible for Auto Finance, one must be a Pakistani citizen between 22 and 65. With minor variations, this age bracket varies from bank to bank. To finance the vehicle Installments, the candidate must have a constant way of income. Salary income, rental income, agricultural revenue, and business income are all examples of this type of income. The Car Loan Calculator can help you figure out how much you’ll have to pay each month on your car.

-

Passport-size photographs, copies of National Identity Cards, bank statements for a specific period (to determine consistent income), and salary certificates for salaried individuals are typically required documents. Some other banks may also require further paperwork. The source of money will have a significant impact on this.

- The financing case is transferred for further processing after the eligibility conditions are met, and the necessary documentation is in place.

- This entails the case’s verification. To reduce the risk on the bank’s end, pre-approval inspections should be established to assure economic establishment. When the bank has affirmed this facility, the car is given and addressed to the client. This will involve the upfront amounts from the client.

- New car financing rates of the car ranges from 17% to 21%, It depends on the term of the finance and the kind of negotiation. Variable interest rates range from KIBOR+3 percent to KIBOR+5 percent, depending on the same factors.

The cheapest way for a new car financing

A 0% spending credit card could be the following cheapest way to borrow, depending on the price of your new car. You would own the vehicle outright, just like if you pay cash, and you will get protection by Section 75.

You should verify with the car dealer to see if they accept credit cards, as not all do.

Does Financing a car build credit?

In the end, meanwhile, car financing Pakistan does not help you develop credit; but you can use it to assist you in improving your score. A car loan has two common credit effects. It improves your credit rating.

This boost can help you improve your credit score if you don’t have any late or missed payments. I am sure this guide will help you secure car financing in Pakistan with the best bank.