The power sector circular debt has jumped by Rs 47 billion during July 2025, primarily driven by power distribution companies (DISCOs) underperformance.

The poor performance of Discos led to a loss of Rs 87 billion on account of low recovery and losses against Rs 42 billion during the same period last year.

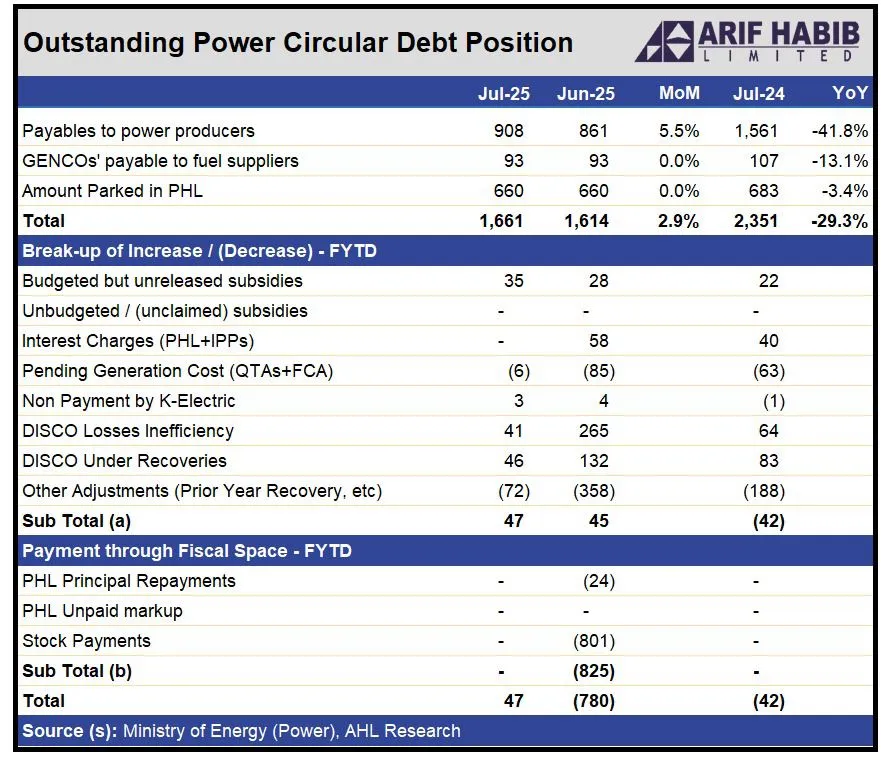

Power sector circular debt stood at Rs 1.6 trillion as of Jul-25 compared to Rs 2.3 trillion in Jul-24. During Jul-25 FYTD, it rose by Rs 47bn compared to a reduction of Rs 42 bn in the same period last year, primarily driven by DISCOs’ underperformance.

Payables to power producers surged to Rs 908 billion in Jul-25, up 5.5% from the previous month. GENCOs’ dues to fuel suppliers remained unchanged at Rs 93bn. The amount parked in Power Holding Limited (PHL) stood steady at Rs660bn.

On a year-on-year basis, payables to producers fell sharply by 41.8%, while GENCOs’ liabilities declined 13.1%, reflecting the government’s recent efforts to slow the debt build-up.

The fiscal year-to-date increase of Rs 47 bn came despite certain offsetting adjustments. Budgeted but unreleased subsidies contributed Rs35bn in Jul-25.

DISCO inefficiencies and under-recoveries added Rs41bn and Rs46bn, respectively. Other adjustments, including prior year recoveries, reduced the debt burden by Rs 72 bn. Pending generation costs dropped by Rs6bn. Non-payment by K-Electric has added Rs 3 billion, which underlines the financial strain within the private utility.

No repayments on PHL principal or unpaid markup were recorded during the period. Last year, a payment of 801bn was paid through stock settlements that reduced circular debt during the same period last year.