FIA steps in after Banks refuse credit to OMCs, Refineries

Ibn-e-Ameer

Federal Investigation Agency (FIA) has stepped in after commercial banks show reluctance to extend credit to oil marketing companies (OMCs) and refineries in Pakistan.

At present, Cnergyico is operating with the lowest working capital facility.

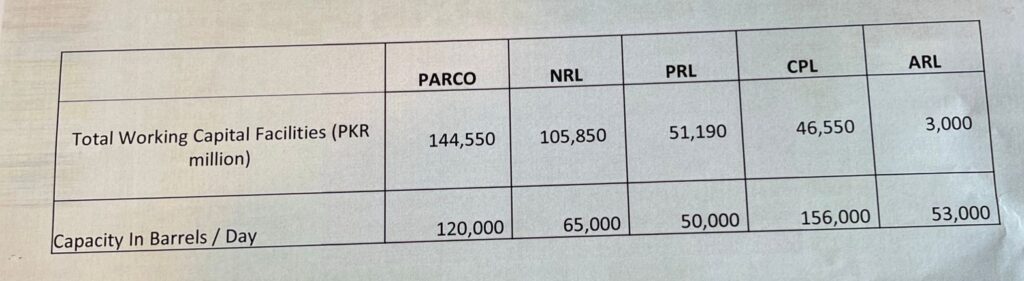

At present, the total working capital facilities available with Parco is Rs 144,550 million, NRL Rs 105,850 million, PRL Rs 51550 million, CPL Rs 46550 million, and ARL Rs 3000 million.

At present, FIA is conducting a criminal investigation against officers of the National Bank of Pakistan (NBP), allegedly involved in facilitating M/S Hascol Petroleum Limited with malafide intention.

Oil Companies Advisory Council (OCAC) had written a letter to the governor State Bank of Pakistan (SBP) seeking intervention after banks had declared oil companies as risk entities.

Following this, banks had refused to extend credit limits to Oil Marketing Companies (OMCs) in Pakistan which had irritated the OCAC.

Vitol’s $89m investment wiped out in Hascol Petroleum

The oil industry lobby had also informed the governor state bank and federal government that the reluctance of banks to extend financing may lead to an oil crisis in the country.

Banking Operations with OMCs in Pakistan

Now, Federal Investigating Agency (FIA) had written a letter to the President of All commercial banks of Pakistan relating to the review of banking operations with Oil Marketing Companies (OMCs).

It said that FIA Sindh Zone I is conducting a criminal investigation against officers of the National Bank of Pakistan (NBP) who are government servants/ Bankers involved in facilitating M/S Hascol Petroleum Limited with malafide intention.

The anti-corruption watchdog said that it had resulted in the loss of billions of rupees to the bank through malpractices.

It further revealed that the investigation conducted so far reveals criminal negligence on the part of the Bank to follow prudent banking practices.

The basic purpose of the investigation is to fix responsibility and ensure the conviction of those involved in criminal acts.

Further, to obviate the risk of avoidable loss to the public exchequer in the future, and at the same time, to raise the bar of due diligence and regulatory scrutiny/oversight at the appropriate fora.

Recently, this agency had come to know that banks are showing hesitation in doing business with OMCs, apparently due to the investigation that is undergoing.

In this connection, it is to reassure that this Agency fully supports any and all efforts of the Banking industry to enter into any restructuring of its exposure to HPL as it deems fit, as per law, FIA said in a letter.

FIA further said that this agency also unequivocally assures all concerned to conduct this investigation that shall continue with the highest professional standards. It further said that it should not be a source of concern to those not guilty of misconduct/breach of trust.