PSO books Rs 6.7b Exchange Rate Gain against SNGPL on LNG supply

Ibn-e-Ameer

Pakistan State Oil (PSO) has booked an exchange rate gain of Rs 6.75 billion against Sui Northern Gas Company Limited (SNGPL).

In addition to it, PSO is also to receive a Rs 5.7 billion exchange rate differential on 25 loans.

SNGPL has to pay Rs 236.6 billion to PSO which included Rs 6.75 billion Exchange Rate Gain.

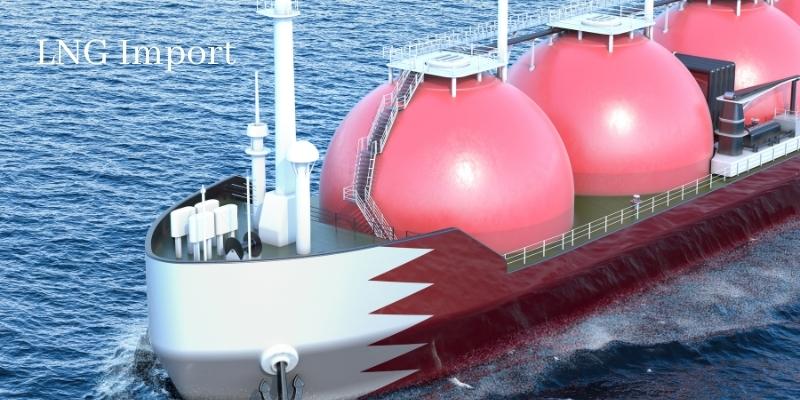

PSO supplies LNG to SNGPL

The financial crisis in State-run oil marketing company Pakistan State Oil (PSO) continues worsening as its receivables crossed Rs 442 billion mark.

PSO Touches Rs 397b Debt for First Time In History

The major contributor to the financial crisis is LNG for the PSO which is to receive Rs 236.6 billion from gas utility-Sui Northern Gas Pipeline Limited (SNGL).PSO imports LNG from Qatar and supplies it to the gas utility onwards to the consumers.

In a bid to overcome the gas crisis, the federal government has directed SNGPL to divert LNG towards domestic consumers in the winter season.

However, the gas utility has been unable to recover the cost of LNG from domestic consumers due to a lack of legal framework.

Now, Parliament had approved the weighted average cost of gas (WACOG) Bill that will enable the SNGPL to recover the cost of LNG from domestic consumers.

The power sector is to pay a total amount of Rs 167.45 billion to a state-run oil marketing company.

Gencos are other key defaulters of PSO that are to pay Rs 140.8 billion.

Hub Power Company (Hubco) is still a defaulter of Pakistan State Oil (PSO) despite receiving billions from the government under the revised deal. It has to pay Rs 21.48 billion to PSO.

KAPCO is also to pay Rs 5.79 billion to PSO.

Pakistan International Airline (PIA) is also a major defaulter of PSO that is to pay Rs 22.4 billion to PSO on account of jet fuel supply. PSO is to receive Rs 9.7 billion price differential claims (PDC) from the government on petroleum products.

Payment to Refineries

PSO is also to lift petroleum products from local refineries. It has to pay Rs 27.6 billion which included Rs 17.16 billion Parco, Rs 2.5 billion PRL, Rs 1.3 billion NRL, Rs 5.5 billion ARL, and Enar Rs 1.03 billion.

Byco is the only refinery that is not to receive any amount from PSO.

Despite peak receivables, PSO continues to make a profit due to higher profits through inventory gains. The government had recently made a massive increase in the prices of petroleum products that would help the company to make additional profits.