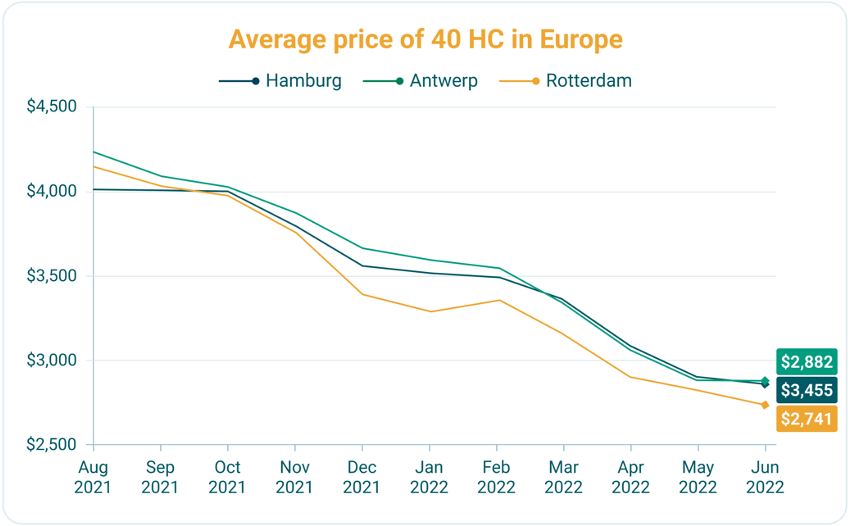

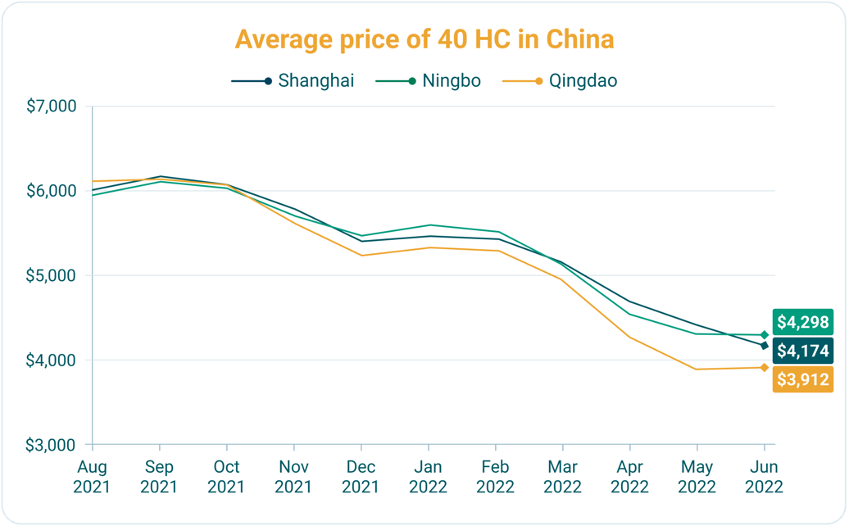

Oversupply causing second-hand container prices to plummet

Hamburg, Germany: The oversupply of containers is contributing to second-hand container market prices plummeting, Container xChange shared in a recent analysis.

The current situation of oversupply of containers is a result of a series of reactionary market disruptions that began soon after the outbreak of the pandemic in early 2020.

The rise in demand led to an increase in congestion at ports, holding up container capacity for a considerably long period of time. This led to the panic ordering of new boxes at record levels.

With time, as markets reopen and demand softens, the oversupply is a natural outcome of demand-supply forces balancing at new levels.” said Christian Roeloffs, Cofounder and CEO of Container xChange, a tech platform that simplifies the logistics of container movement.

Short to mid-term outlook on freight rates, spot rates and container rates

Freight rates have come down by approximately an average of 20% since the beginning of the year 2022, and these will continue to slide gradually.

But there will not be a massive decrease because the underlying disruptions in the supply chain are still there.

Inflation, for one, has started to create build stress on the US economy and the EU. With inflation and pandemic-induced lockdowns, disruptions will continue to change the equation between supply, demand and prices. In the longer term, these will phase out and create a new normal balance of supply and demand.

Fresh data published by Drewry indicates an excess of 6 million TUEs of capacity in the global fleet of containers.

Container xChange analysis further states that the oversupply will obviously lead to the requirement of more depot space which is already scarce.

And in a scenario where we assume that the global supply chain disruptions will fade away with time, there will be higher box productivity and we will need fewer boxes per unit of cargo.

As we witness the easing of supply chain disruptions in the coming months, it will lead to higher box productivity and a structural surplus of containers.

If we also see further softening of demand, this will increase the supply of containers available for cargo.

Possible Scenario of Equipment Capacity

There is a high possibility of a scenario where the equipment capacity will not get soaked.

“This situation will lead to tighter depot space, carriers will rush to get rid of their older equipment, second-hand container prices will continue to slide gradually only to reach a new normal level and the new market will dry up.”

The situation can be studied from the perspective of the market forces of demand and supply. If the demand for containers falls (resulting from the decline in consumer demand over the course of the next few months considering, the rising inflation which could contribute to negative consumer sentiment).

US Trade Representative wants to boost trade with Pakistan

Then the supply of containers will naturally increase. Also, price is a function of demand and supply. If demand falls and supply increases, prices will fall. And that is what is currently happening with the container prices.

The shape of the Peak Season and container prices

We’ve said before that the main factor that has driven up prices much more than the historical levels has been a supply-side crunch over the past two years because of lengthening turnaround times of containers caused by supply chain congestion.

That still holds true. We still have about 10% of transport capacity tied up and removed from the value chain. Demand on the other hand has softened now.

U.S. Imports decreased by 2.4% between March and April. Purchases of goods went down USD 0.1 billion as higher imports of industrial supplies and materials (up 1.8 billion) were offset by lower imports of consumer goods (down 1.5 billion). source: U.S. Census Bureau

An interesting point is that in the long run, ocean freight demand is forecasted as a multiplier of global GDP growth.

And if global GDP doesn’t plummet by for instance 5%, the global demand for shipping capacity will not significantly plummet.

“To sum up, we foresee a significant rise in the pent-up, peak season demand.” This will likely keep container prices potentially stable (preventing them from falling further down or skyrocketing) in the short term as we inch closer to the peak season.”