What ATMs are Free For Cash Apps Card| 89 ATMs That Support Cash Apps!

What ATMs are free for cash apps Card? There are 89 ATMs around you that can withdraw your money from the Cash app.

Looking for an ATM to withdraw money from your Cash app card without paying any fees?

The Cash app has partnered with thousands of in-network ATMs around the country, allowing you to make free withdrawals from your account.

Find out more here about the locations of these ATMs and how to access them.

What ATMs are Free For Cash Apps Cards? 89 ATMs That Support Cash Apps!

Are you a Cash App user? Then you must want to know about the Cash App ATMs around you.

Because going to an ATM and withdrawing money has its own fun and joy. No experience can replace going to an ATM.

Not only that, having an ATM is crucial when you have to withdraw your money. Because you can’t always go to the bank. Right?

So, now the question is: What ATMs are free for cash app Cards? There are many ATMs around you that can withdraw your money from the Cash app.

I’ll tell you about them one by one. I’ll also tell you how to withdraw money from your Cash app in other ways.

Read More:- How to get free money on the cash app instantly |Here are 16 Ways

- 10 Best Cash App Games That Pay Real Money in 2023

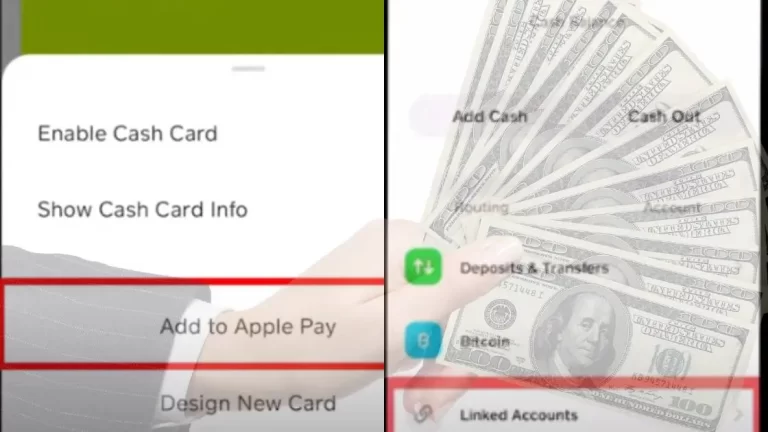

- How To Transfer Money From Cash App To Apple pay| An Ultimate Guide

- How To add Credit Card to Cash App | Few Steps you Should Know

- How Does Cash App Show on Bank Statement?

- How Does $100 boost work on Cash App| Boost Money Today!

- How Does Cash App Round up Work| Invest and Save

You’ll benefit greatly from reading this article, so make sure you stay around until the end so you can learn everything you need to know.

I’m going to get right to the point without being late.

Cash App/ A Quick Overview

Cash is a sophisticated peer-to-peer payment system that allows you to send and receive funds quickly.

In 2013, Block, Inc., the former Square, Inc., released the Cash App to compete with PayPal and Venmo, two other mobile payment apps.

It’s worth mentioning that Cash App is not a bank; it is an online financial platform.

It offers debit cards and financial services through its bank partners.

Your remaining balance in your account is insured by the Federal Deposit Insurance Corporation (FDIC) through partner institutions.

The thing I like the most about the Cash app is that it is operated by Cash App Investing LLC, which is a broker-dealer.

It is registered with the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulation Authority.

A number of investing services are offered by Cash App Investing LLC (FINRA).

You can also get free money if you borrow money from different loan apps that work with Cash App.

Here are also apps you can sign up and make money.

So, now the question is, what are the best ATMs for withdrawing money from a cash app? That’s what we’re going to talk about now!

What ATMs are free for cash apps? Can I use it for Cash App Money Withdrawal?

Cash App is a payment system that allows withdrawals from any ATM.

No matter what ATM you go to, you’ll be able to withdraw your money from your Cash App account.

Sounds interesting, right? A lot of people have doubts: if they only have a cash app account but no bank account, then how on earth they would be able to use ATMs to withdraw money from the cash app?

The good news is that no bank account is required to withdraw money from the Cash App account using any of the bank accounts.

If you want to withdraw money from a bank’s ATM, here is a list of them.

Remember, you’ll be charged some money on every transaction you do. I’ll mention their fees as well.

Depending on where you live, the ATMs listed below will be in different locations.

ATMs For Cash App Near You!

| ATMs Name | Fees |

|---|---|

| BBVA Compass | $2.50 |

| Capital One | $2.00 |

| Citizens Bank | $3.00 |

| Bank of America | $2.50 |

| Comerica Bank | $2.50 |

| HSBC Bank | $2.50 |

| Citibank | $2.50 |

| Fifth Third Bank | $2.75 |

These are the banks’ ATMs that you can use to withdraw money from the Cash app.

As you can see, these ATMs will charge you some money on each transaction.

It means they’re not free. But you came here looking for free cash at ATMs, right?

Then why did I tell you about the paid ATMs that charge you fees?

Free ATMs For Cash App?

What are the free ATMs for cash apps? You’ll be amazed to know that all of the ATMs that you see around you are actually free.

But, wait, then why do they charge you? It’s something you need to understand.

There are two rules that you have to understand. They’re mentioned below!

- Rule 1: You have to live off a $300 monthly deposit, which could come from your salary or insurance.

- Rule 2: According to another restriction, you can only withdraw money three times in 31 days.

The maximum number of free withdrawals each month at Cash App ATMs is three.

In the event that you withdraw money after using up your three free trials in 31 days, you will have to pay about $2 per withdrawal.

I hope you understand. So, do you want me to tell you about some of the other cash app ATMs? Then keep reading!

Best ATMs For Cash App Near You

| ATMs Name |

| Raymond James Financial |

| TIAA |

| Webster Bank |

| Ameris Bancorp |

| East West Bank |

| Discover Financial |

| People’s United Financial |

| M&T Bank |

| Charles Schwab Corporation |

| JPMorgan Chase |

| USAA |

| Citigroup |

| Synchrony Financial |

| Comerica |

| KeyCorp |

| Old National Bank |

| U.S. Bancorp |

| Old National Bank |

| BMO Harris Bank |

| SunTrust Banks |

| BB&T |

| Capital One 360 (formerly ING Direct) |

| U.S. Bank |

| SunTrust Banks |

| BB&T |

| Bank of America Corporation |

| Fulton Financial Corporation |

| The Huntington National Bank |

| Citizens Bank |

| PNC |

| Fifth Third Bancorp |

| TD Bank, N.A. |

| Webster Five Cents Savings Bank |

| The Bank of New York Mellon Corporation |

| BBVA Compass |

| Regions Financial Corporation |

| Capital One Financial Corporation |

| Chase |

| American Express |

| Wells Fargo Bank, N.A. |

| PNC Bank, National Association |

| U.S. Bancorp (USB) |

| SunTrust Banks, Inc. |

| JPMorgan Chase & Co. |

| Bank of America Corporation (BAC) |

| KeyCorp |

| HSBC Bank USA, National Association |

| The Goldman Sachs Group, Inc. |

| Morgan Stanley |

| Citigroup Inc. |

| Barclays PLC |

| Royal Bank of Canada (RY) |

| TD Ameritrade Holding Corporation (AMTD) |

| Capital One 360 |

| Bank of America |

| HSBC Bank USA |

| Regions Financial Corporation |

| Royal Bank of Canada |

| Citigroup Inc. |

| Barclays PLC |

| TD Ameritrade Holding Corporation |

| Ameriprise |

| Hawaii’s Bank |

| Deutsche Bank is a financial institution based in Germany |

| Find out about money. |

| BanCorp is the first of its kind. |

| Nebraska’s First National |

| First Midwest Bank is a bank based in the Midwest. |

| The FirstBank Holding Company is a financial holding company. |

| Whitney Hancock |

| Huntington Bancshares is a stock owned by Huntington Bancshares. |

| RBC Bank |

| Stifel |

| Synovus |

| Financial Synchrony |

| Financial Integrity |

| UBS |

| UMB Financial Corporation is a financial services company based in New York |

| Wells Fargo & Company |

| State Farm |

| State Street Corporation |

This is the list of the best ATMs for your cash app. You can use any of them.

Now, it’s time to talk about some of the other important things related to the transactions at ATMs through your cash app.

What are the Cash App Atm Withdrawal Limits?

All payment systems, including the Cash app, typically have different withdrawal limits.

The Cash App withdrawal limit is only $1, 000.

There is a limit of $7,000 for credit card transactions and a $1,000 limit on ATM withdrawals with Cash App.

The maximum withdrawal amount per day, per week, and per ATM transaction is $1,000.

Is there any app to increase the ATM withdrawal Limit For the Cash App?

Nope, there isn’t any application. Whatever tips and tricks you find online are a waste of time.

Because the Cash app system is quite strong and well-programmed by its management.

No one outside the management team can change any of the settings of the cash app, including its transaction limit.

So, the transaction limit can’t be changed. It’ll remain the same.

So, how can you withdraw money more than the Cash App Withdrawal limit?

Usually, we’re in an emergency and need more money. So, is there any way to withdraw more money from the Cash app than its limit?

Yes, there is a way. Simply contact any of your friends or siblings who have the same Cash App account as you.

Take them with you and withdraw $1,000 from your account and $1000 from theirs.

This way, you’ll be able to withdraw more money. If you need more money than that, then you’ll need more friends.

That’s the only trick. There is no other option.

How To Find The Cash App ATM Near Me?

You can also use google Maps to find out the ATM nearby you are looking for.

What if the list of ATMs that I’ve shared above doesn’t include any ATMs from your city?

Then, in this case, you’ll have to find out which ATMs are nearby where you can withdraw your money. But how do you go about doing so?

There are two easy ways to do that. In one way, you use the cash app itself to find out the nearby ATM locations.

You can also use a locator to find ATMs.

And in the second method, you use a tool that finds the nearby ATM locations for you. So, let’s learn how to go about both methods.

Finding Nearby Atms In Cash App!

Following are the easy steps to find out the ATM location of the cash app. Follow these instructions carefully.

Step 1

- Open the “Cash App” on your smartphone, then sign in using your account information.

Step 2

- Once your homepage has loaded, select “ATM” to give the program permission to track your present position.

Step 3

- Select “Get Location” from the menu, and then wait as the program searches for the closest ATM.

Step 4

- From the results page, pick any local ATM to make a deposit or withdrawal using your Cash Card.

That’s how you use the Cash app to find a nearby ATM location.

Finding Nearby Atms Locations Using A Tool

Step 1

- There is a tool called Moneypass which is for finding the ATMs’ locations around you. The tools are very easy to use. The first thing that you have to do is to go to Moneypass.

Step 2

- Once you’re there, you’ll now be able to see a box on the left side of the page with some options. On the top of all the options under the “Search location” text will be a search bar. Just enter the name of the city you live in.

- Now, there will be a map in the middle of the page where you’ll be able to see all of the ATMs that are near your city. You can zoom in on all of the locations one by one. The locations will be clearly mentioned on the page. So, it’ll be easier for you to spot the ATMs.

That’s how easy it is to find the ATM locations nearby you using the Monepas tool.

What Are The Cash App Atms Fees?

Per transaction, the Cash App ATM charges between $2.00 and $2.50. Since costs vary from operator to operator, this fee may be changed.

Additionally, ATM owners charge an extra fee for cash withdrawals.

However, if you’re using any bank ATM, then the fees may be different there.

It should be between $2 and $2.50 at the maximum.

Is there any way to Not Pay The Cash App ATM fees?

Fortunately, there are two simple ways to avoid paying Cash app transaction ATM fees.

So, let’s go over each of the ways one by one!

Method 1:Use a Cash Card to Check out at Stores that allow Cash Back.

Using your Cash card at grocery stores or department stores and selecting “cash back” will deduct money from your account without any fees.

Method 2: Set up a monthly direct deposit of at least $300!

There are no withdrawal costs if your monthly deposit is $300.

This allows you to withdraw fees-free for 31 days.

The maximum number of withdrawals you can make during this period is three; after that, you will be charged fees.

For ATM withdrawals, Cash App reimburses up to $7 in fees.

You can save a little on your Cash App account by using these methods.

Since everything regarding the Cash app atm has been covered, I’d like to conclude the post here.

FAQs

Q: What ATM is free for cash app card

After you have received a total of $300 or more deposits, you can get unlimited free withdrawals from Cash App at in-network ATMs.You will also qualify for one free withdrawal at those ATMs that are out of its network for 31 days.

However, if you make additional ATM withdrawals out of network during a given time of 31 days, you will have to pay $2.50 and additional ATM operator charges.

Customers who are unable to receive a qualifying deposit of $300 or more, will pay a $2.50 ATM withdrawal fee for in-network ATMs.They will also pay $2.50 plus operator fees if they use out-of-network ATMs for withdrawals using a cash app card.

Q: What is the Cash app withdrawal fee?

You can use a cash app card at any ATM to withdraw money by paying a $2.50 fee which Cash App will charge. If anyone uses of network ATM, he will have to pay a $2,50 fee and an additional ATM operator fee.

Q: What is the cash app ATM withdrawal limit?

Anyone with a Cash App card can receive cashback and cash out from ATMs. Its withdrawal limit amounts to $1,000 per day. Cash App card has a $1,000 per ATM transaction limit and $1,000 per week.

Q: How to get a cash app card

You can get a cash app card for free. In order to receive a cash card, you will require a verified account, date of birth, mailing address, full name, and last four digits of SSN on your name.

Is Walgreens ATM free for cash app?

If you are a Cash App customer, you can avail of unlimited free withdrawals. It applies to those customers who receive $300 (or more) in paychecks which are deposited directly in the account of the cash app every month. You can withdraw money with the help of Walgreens.

What ATMs can I use for the cash app?

There are 89 ATMs that you can use to withdraw money with a fee of $2.50 fee which Cash App charges. However, you will have to pay an additional operator fee if you use a cash app card at out-of-network ATMs.

Is 711 ATM free for the cash app?

Yes, you can make ATM withdrawals at 7-Eleven ATMs with the MoneyPass logo as they are part of in-network ATMs.

How to get money off the cash app at the atm?

You can withdraw money using a cash app card at any ATM with the help of your cash PIN.

Final Words

What ATMs are free for cash? I’ve shared two complete lists of the ATMs that you can use to withdraw money from your Cash app.

Remember one thing: you can use any ATM to withdraw money from the Cash app even when you don’t have a bank account.

However, you will be charged for this, which can range between $2 and $3.

I’ve also mentioned two simple methods for avoiding Cash App transaction fees.

As a result, you can get the most out of them.

If you can find any ATMs in your city on the above list, that’s fantastic.

But if you can’t find any, then you can use the Moneypass tool or the Cash app to find nearby ATM locations.

You also know how you’ll use both of them to find the ATMs.

So, that’s all I had for you in this article. If you have any questions related to the topic, please let me know in the comment section below.

I’d love to help you out. You can also contact the Cash App support team to seek help.